- The Prime Wave

- Posts

- Buy The Dip!

Buy The Dip!

OK, but what counts as a dip?

THE BIG IDEA

For many individual investors, “buying the dip” has proven to be a solid strategy for many years. Nothing works perfectly, or forever. So, let’s begin the new year by reviewing whether buying the dip was still a good idea in 2025.

First things first. We need some way of recognizing when a short-term dip in the stock market has occurred.

Some people make the mistake of just looking at a historical price chart and identifying the places where the chart made a local bottom. If you do this then buying the dip seems to work 100%. By definition, prices can only ever go up from the bottom.

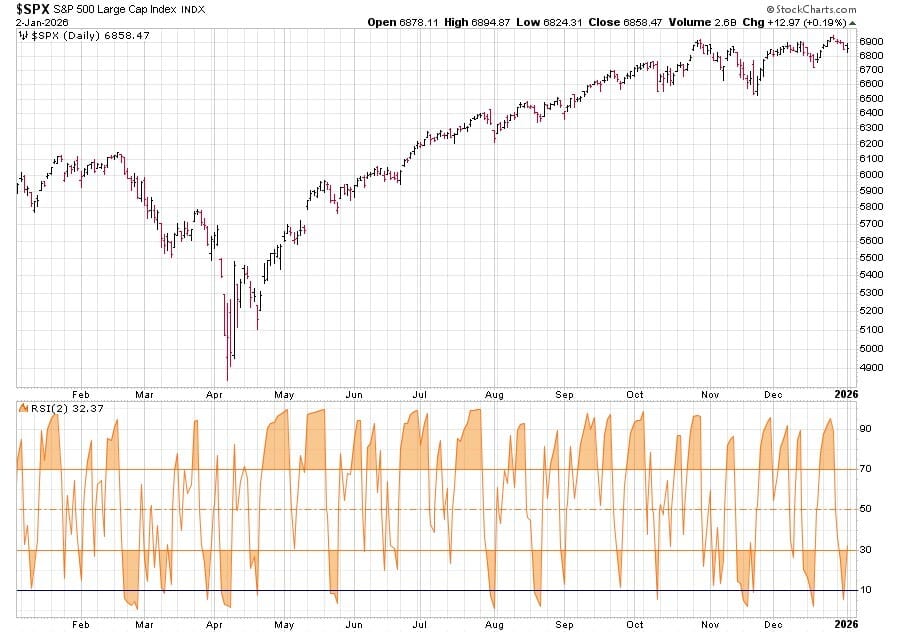

Anyway, we need to place our trades in real time. How will we know a dip when we see it? We prefer to use the Relative Strength Index (RSI) for that. Except we swap out the standard 14-day look-back period for 2 days and then consider that a dip happens when the RSI value gets down into single digits.

In the chart above, we have the S&P 500 in the top panel and our RSI(2) value plotted in the lower panel. There were 12 distinct “dips” in the market according to this definition. Some of them might be better described as soul-crushing plunges, but that is a topic for another day.

Now, this is where it gets tricky. When to sell after buying the dip differs from person to person, depending on their risk tolerance and stubbornness. We are going to use the same approach we use for monitoring the Swingex Index. That means we will look ahead 3 days to 3 weeks and assume we sell at the median closing price of those 13 days.

Here are the results:

You might remember there was some wild, wacky stuff happening in the stock market last spring. It led to some outsized moves in both directions, and you can’t have one without the other. We can’t completely dismiss those results because maybe something chaotic and weird will happen this year, too.

Overall, it seems that buying the dip is still a reasonable way for individual traders to behave. That’s especially true if you can improve on our dumb, random-ish selling rule.

SEEN ON THE INTERNETS

You may remember r/wallstreetbets from such pandemics as COVID-19. If you haven’t been paying attention, the community is still alive and well on Reddit.

Last week they asked participants to post one stock they thought would do well in 2026. The 10 most popular ticker symbols are copied below.

They did the same thing at the end of 2024 and that list produced a 76% return in 2025.

For this year, they are bullish on space as well as some Magnificent 7 stocks. And of course some AI-related companies, including Reddit itself. No “boring” stocks on the list. This subreddit is not going to look at companies like Citigroup or Walmart (even though they were up 70.4% and 24.5% last year).

NUMBERS ONLY

8.70% | Everybody tells you the best and worst stocks of the past year. What about the median? Genuine Parts (GPC) was the 250th best performer on the S&P 500 with a gain of 8.70%. |

- 4.46% | Nobody got coal for Christmas? The Dow Jones US Coal Index was down 4.46% from Christmas Eve through the end of the year. |

5 | On December 31st the S&P 500 dropped 0.74%, making it the 5th year in a row that the market finished the year with a negative day. |

SWINGEX INDEX

As of market close on: 2 January 2026

|  |

Swingy says: And so it begins. The new year starts with cromulent but not spectacular conditions for a trade.

Learn more about how the Swingex Index works here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

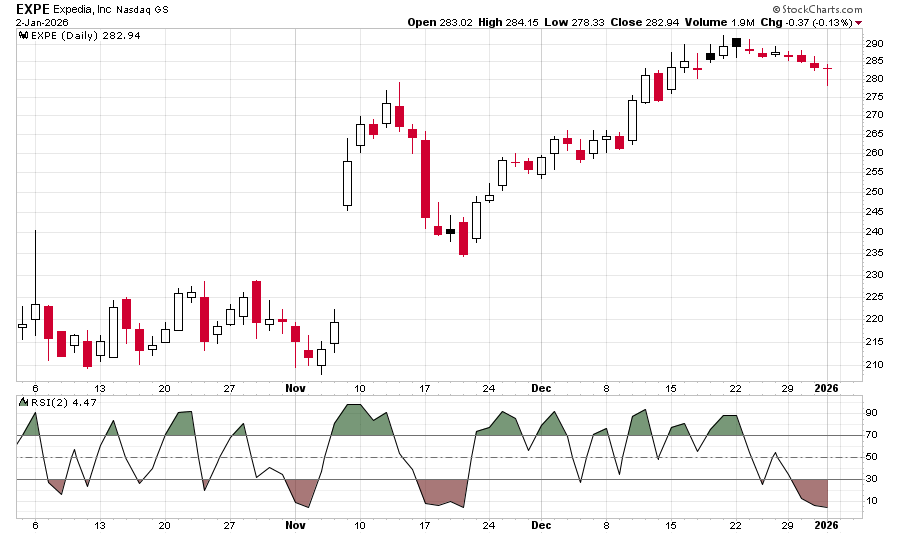

EXPE (Expedia): Ever since the tariff debacle last spring, EXPE has been a steady climber.

The stock made the latest in a series of all-time highs just before Christmas. It’s been drifting slightly lower during the holidays, but the chart above gives us two reasons to expect a move higher from here.

First, Friday’s trading produced a dragonfly doji candlestick. The market probed for lower prices, but buyers came in and took the stock back up to where it started. So EXPE seems to have some support at a nearby lower level.

And, continuing the theme from this week’s Big Idea, the RSI(2) value is in single digits. The interpretation for individual stocks is the same as for an index: a short-term dip is likely to be reversed.