- The Prime Wave

- Posts

- Feeling Fine

Feeling Fine

Will the Fed’s decision on interest rates on Wednesday burn down the house?

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

Flipping through many stock charts this weekend, the main theme that came from it is that many stocks rebounded well from their November low but are still well below their recent high.

Will the rebound continue? Or will the market roll over for another leg downward? Nobody really knows, of course. But there might be a clue in market sentiment. So let’s take a quick tour of the usual indicators of exuberance.

Chart from AAII.com

AAII sentiment survey - Pictured above, we see that the portion of individual investors who are bullish jumped to 44.3% from around 32% in previous weeks. The number is now approaching its 1-year high water mark. So, individuals are somewhat bullish, but they could still become even more bullish.

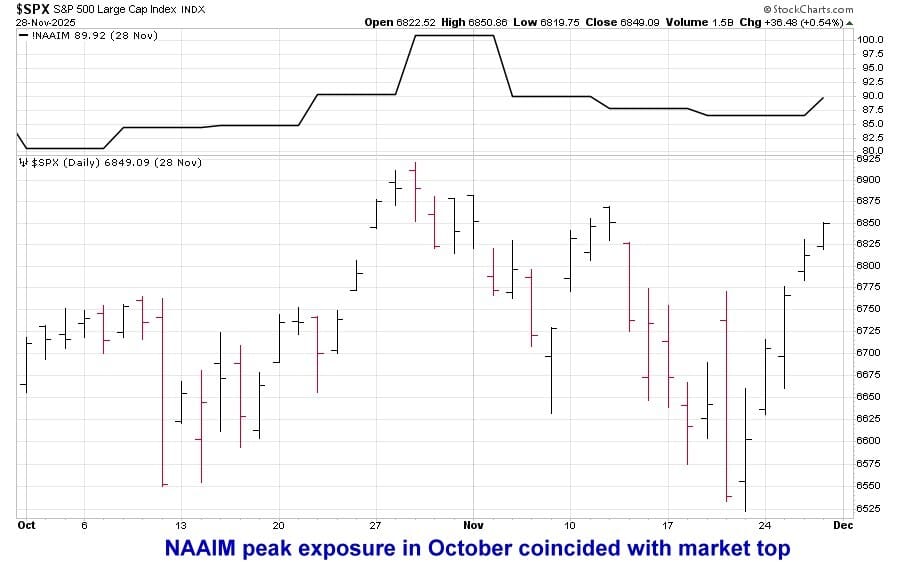

NAAIM exposure index - The professional money managers are just about as bullish as they ever get. The latest reading is 98.57, which is at the high end of its normal range. That doesn’t mean that it can’t go even higher. A number over 100, as happened in October, would be a serious warning for the market, but we are not there yet.

|  |

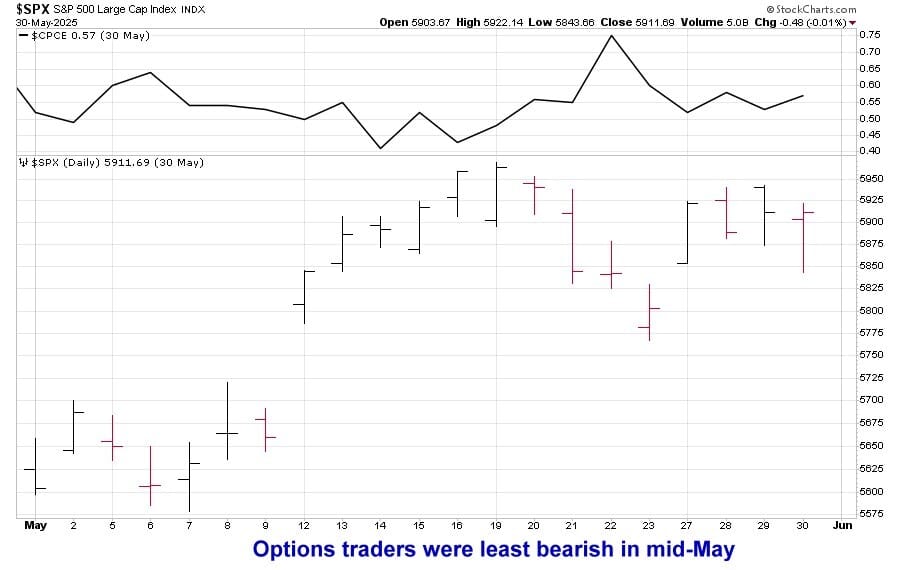

Equity Put/Call ratio - Options traders buy Puts when they anticipate a drop in the market or at least want to hedge against a possible fall in their current holdings. They are not interested. The number of Puts on individual stocks relative to the number of Call options is at the lowest level since May.

VIX volatility index - Similarly, the VIX, which is based on options trading for the S&P 500 index itself, is at a low-ish level. The market is unconcerned about future volatility.

Last but not least, the Swingex Index is at a dismal -5. The index has a theoretical worst case of minus 10, but in practice it rarely goes lower than its current value.

All of this adds up to the potential for a weak stock market between now and the holidays. It doesn’t have to plummet today or even go down much at all in the short term. The market can still try to enjoy some Christmas punch and keep the buzz going a bit longer. Just don’t be the last one to join the party.

And keep an eye on that fire in the fireplace.

SEEN ON THE INTERNETS

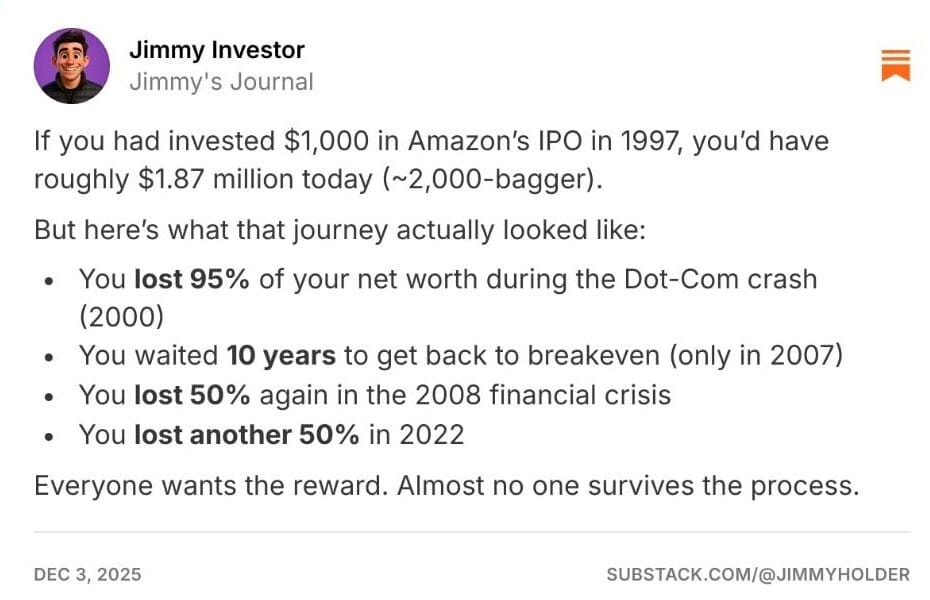

This week’s Seen On The Internets is something we all have seen on the internets from time to time. Yet it is worth seeing again, because this example comes with a twist.

The story usually goes something like this: If you had bought shares of (big, successful company) back when it was just getting started, you would be filthy stinking rich today!

This time around, we found an example posted by somebody calling themselves Jimmy Investor (probably no relation to Johnny Football) on the Substack platform. But Jimmy comes at it from a different angle.

When we hear about the fantastic fortunes that we could have made, those stories usually overlook all the regret and suffering we would have needed to overcome along the way.

Only the mentally impaired would hold on to a stock through a 95% drawdown and then also all the way back up to the previous top.

Hat tip to Jimmy for a realistic what-if.

NUMBERS ONLY

- 2.61% | A basket of the 100 least volatile stocks in the S&P 500 dropped by 2.61% last week. That is the largest weekly decline since the tariff mayhem in the spring. |

10 | Technology stocks, as measured by the XLK ETF, are on a 10-day winning streak, yet still below where they were a month ago. |

17183.12 | The Dow Jones Transportation Average reached a 52-week high of 17183.12 on Friday. |

SWINGEX INDEX

As of market close on: 5 December 2025

|  |

Swingy says: Don't jump into the market now. Take the money and run before the gorillas figure out what is going on!

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

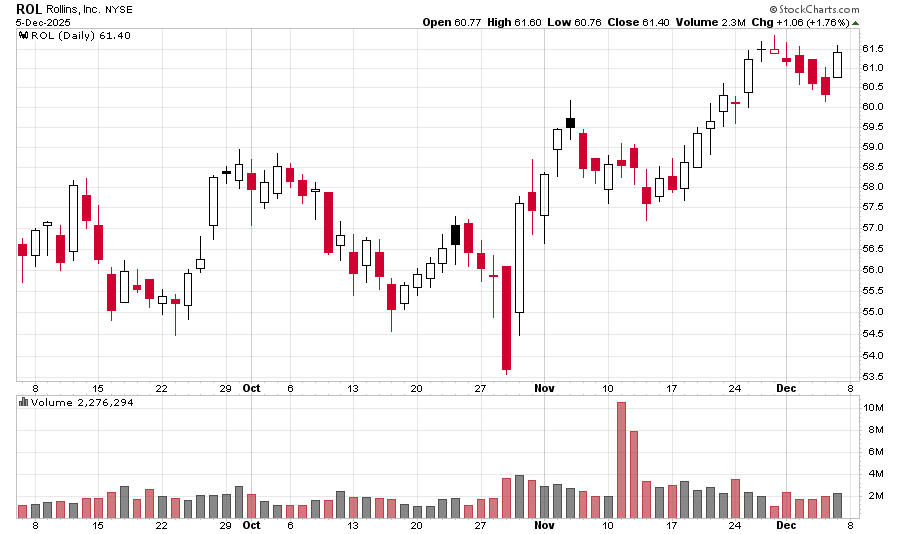

ROL (Rollins): The market is looking ripe for a potential fall, so this week we are sticking with a mundane company that has recently made an all-time high.

Bug-killer Rollins has been a slow and steady riser for years. You can buy-and-hold it if you want, but we are only interested in what it might do for us between now and Christmas. Currently, the stock is just 10 cents below the all-time high set the day before Thanksgiving. Between then and now, there was a benign countertrend move that looks to be over.

We might only get a few percentage points here but now is not the time to be greedy.