- The Prime Wave

- Posts

- Flatlining

Flatlining

The dullness of late summer may be ending.

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

It is the start of Q4 of 2025, so this week we decided to take a look back at the recent past and see how things are going.

TL/DR: Pretty OK, but nothing fantastic or exuberant.

For us, the two defining moments of recent months were the ugly market drop on July 31 / August 1 and then Jerome Powell’s speech at Jackson Hole three weeks later.

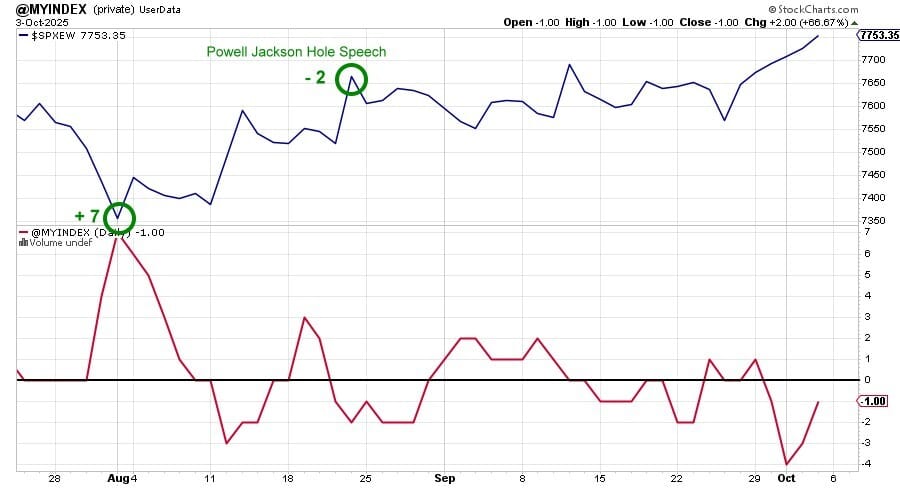

In the chart below, we have the equal-weighted version of the S&P 500 in the top panel and the Swingex Index in the bottom panel.

For both events, the Swingex Index delivered for us. The +7 it printed on August 1 kept us bullish when you could have been forgiven for wanting to go conservative.

Powell’s speech generated a -2. In the newsletter that weekend, Swingy told us the index was “not impressed”. And then the market just chopped sideways from there through the end of September.

The Swingex Index never strayed beyond ±/- 2 the whole time and we were beginning to wonder if the index was broken. It turns out that it just kept repeatedly telling us that nothing much was going to happen.

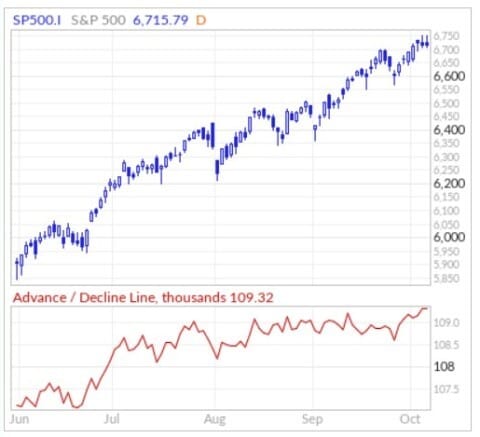

Below we have plotted the “normal” cap-weighted S&P 500 along with the Advance-Decline line for that index.

Once again here you see that the number of advancing stocks versus declining stocks stalled out starting in August.

The calendar flipped to October and finally there was a more extreme index reading. Wednesday gave us a -4 followed by a -3 on Thursday. Maybe it is just a dark cloud passing by that will not dump any rain on us. Or maybe not.

The Swingex Index is not an all-knowing crystal ball. It gets the market wrong sometimes. Still, we should pay attention when it gives us big-ish negative numbers. Have an umbrella ready.

SEEN ON THE INTERNETS

This week we seen something posted by Mary Ellen McGonagle of MEM Investment Research. She posted an article on the Stock Charts website titled Three Brand Name Companies Outside Of Tech That Are On The Move.

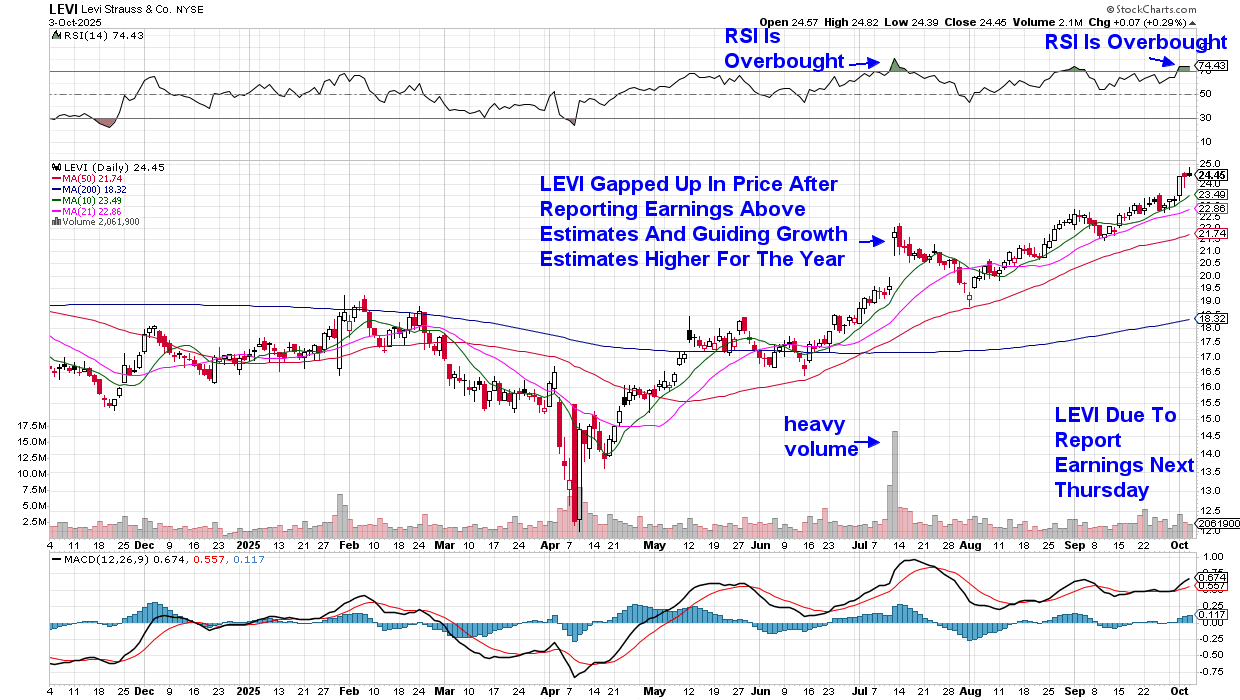

One that looked interesting is Levi Strauss (LEVI). The company says it is in a good position to manage tariffs (which surely will come, or not, and may be higher or lower than the currently imagined rates) by shifting supplies among the numerous countries where it operates.

McGonagle thinks the shares may succumb to a pullback after the upcoming earnings report, which would then be a good buying opportunity. The annotation on the chart below is McGonagle’s.

Buying ahead of the earnings report and expecting another jump similar to three months ago is not recommended. LEVI is already “overbought” based on the RSI(14) indicator.

In the same article, McGonagle also reviews Chipotle (CMG) and Gildan Activewear (GIL).

NUMBERS ONLY

14.31% | The NASDAQ 100, which includes all of your favorite tech stocks, is 14.31% above its 200-day average. |

$7500 | The U.S. tax credit for electric vehicles has ended. What that meant for EV sales in Q3 and will mean for future sales is a hot topic for debate. |

4 | Four of the 30 stocks in the Dow Jones Industrial Average reached all-time highs on Friday. Congratulations to Caterpillar, Johnson & Johnson, NVIDIA, and The Travelers Companies. |

SWINGEX INDEX

As of market close on: 3 October 2025

|  |

Swingy says: Still underwater. This ain't the time to planning a trip to the moon.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

ETOR (Etoro): Knowing that the Swingex Index has been below zero lately and that we are coming to a time of year when mutual funds tend to unload their losing stocks, this week we look at a short candidate.

Etoro was a hot IPO earlier this year. It’s IPO price of $52 is that little dot on the chart from back in May. Things have not gone well for ETOR lately, and the IPO buyers as well as nearly everyone else who bought the stock since then is now underwater.

The stock hasn’t managed to close above its 20-day moving average for two days in a row since July. There is nothing else on the chart to give you the feeling that a bottom may be coming soon.

We see it as likely to head still lower in the short term. Maybe a total washout day will come and provide buyers an opportunity to come back.