- The Prime Wave

- Posts

- Going Down While Going Up

Going Down While Going Up

Stocks are going up, aren't they

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

We are going to begin this week’s newsletter with a crazy idea.

When “the stock market” is going up, it means that most stocks are going up.

This is hopefully not a controversial statement. It’s what most of us probably understand to be a “bull market”. Can we even have a bull market if many stocks are not going up?

Well, yes, if you consider the S&P 500 index to be representative of the stock market. The way the index is calculated gives 40X more weight to NVIDIA than it does to a chain of coffee shops called Starbucks.

(Let’s not even get into the primitive way the Dow Jones Industrial Average is calculated.)

In the chart below, we see a YTD plot of the S&P 500 in the lower panel along with the percentage of those stocks that are above their own 50 day average in the upper panel. If a stock is “going up” you would expect it to be above that average price.

The percentage of stocks that are “going up” actually peaked on the first day of July, according to this definition. It has been trending lower ever since then.

Even in the best of times, that number does not stay above 70% for long periods. However, it is not asking too much for the percentage to zig and zag between 50% and 70% in a healthy bull market.

For the last two months, though, it has managed to get above 60% on only one day. One stinkin’ day. As we start the new week, only 43.6% of S&P 500 stocks are above their intermediate term average.

There are two ways of looking at this:

The leak of money out of the stock market for months will eventually come for the biggest stocks that dominate the index.

A stealth consolidation or correction has been going on for a while now for the majority of stocks and, after a needed rest, they might continue higher.

We’ll see what happens!

SEEN ON THE INTERNETS

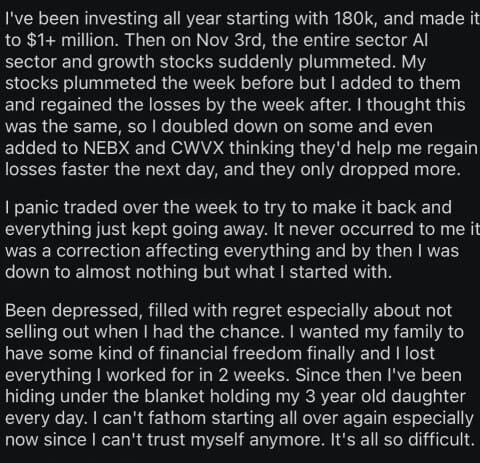

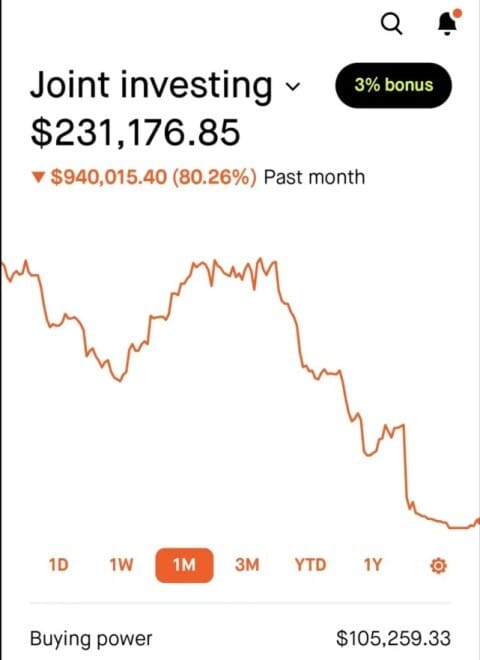

Someone who goes by the handle MisterSplashyPants and previously “wha1e” (that’s a number 1 and not a letter L) on the Stocktwits website reposted the screenshots seen below of some unknown trader’s tragically bad two weeks and added his opinion of the situation.

Read this trader’s story on the left and then check out the numbers on the right.

|  |

The post and some of the ensuing comments on Stocktwits focused on this person’s ability to manage their money. We come at it from a different angle.

Kahneman and Tversky suggested that we humans often make decisions by comparing to some reference point. Those retail shops that are perpetually having sales want you to compare their offered price to the “full” price, even if the full price never actually existed.

Our trader here clearly compared his account balance to a recent high-water mark. He bought some leveraged ETFs to “regain losses” from the previous week even though he was up by around 5X for the year.

Because of it, he blew 80% of a $1 million account in two weeks.

NUMBERS ONLY

+ 0.08% | The S&P 500 was up 0.08% last week. Just a quiet week in the market, obviously. Nothing to see here. 😉 |

5 | Energy stocks, as represented by the XLE ETF, are on a 5 week winning streak. XLE had been flat for the year until this run. |

- 17.43% | The company formerly known as Microstrategy (MSTR) was down 17.43% last week. Is the next Bitcoin winter coming? |

SWINGEX INDEX

As of market close on: 14 November 2025

|  |

Swingy says: The index is not getting clear signals from the market, so I will go play pickleball while it gets sorted out.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

CBOE (CBOE Global Markets): Are hyperscalers, AI providers, and quantum computing stocks going to rebound or continue deeper into a bear market? Who knows? One thing we do know is that CBOE will be there to facilitate the trading.

Their earnings report at the end of October sprung the stock into what is shaping up to be a possible bull flag pattern. After a 10% run the stock is now taking a few days to digest those gains.

So long as the stock doesn’t give up much of its recent advance and volume remains subdued, look for CBOE to continue higher in the near future.