- The Prime Wave

- Posts

- Hammering

Hammering

A chartist's best friend has made an appearance.

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

The “hammer” is one of the simplest, and most reliable, candlestick patterns.

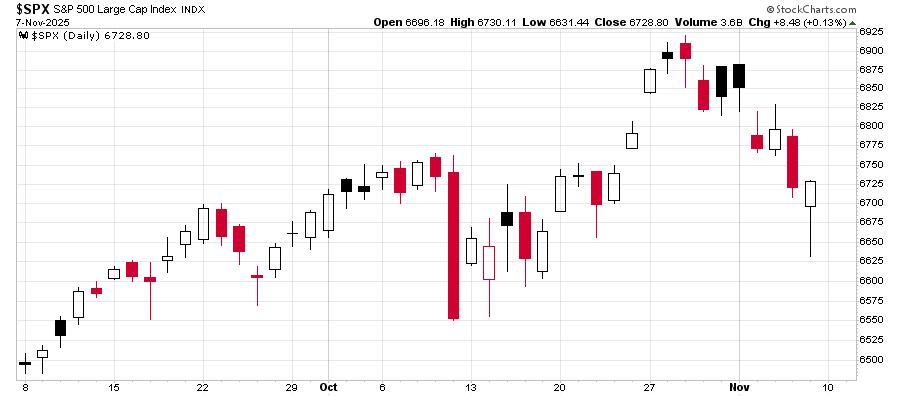

Last Friday’s trading activity produced a hammer candlestick, so we are making it the subject of this week’s newsletter.

Let’s begin by looking at a textbook example of a hammer. The diagram below illustrates a classic hammer candlestick. It looks like, well, a hammer! It doesn’t matter too much if the closing price is above or below the opening price. The important thing is that both are toward the top end of the range with a somewhat lower lowest price.

Also important! A valid hammer can appear only after a downtrend in prices. The exact same visual representation in an uptrend has a radically different interpretation! But that is a subject for another newsletter.

The western world was introduced to candlestick analysis by Steve Nison’s book Japanese Candlestick Charting Techniques. Many of us today still rely on this book as the authoritative source for all things candlestick.

In that book, we learn that the Japanese word for this candlestick formation is takuri. It is described as meaning “trying to gauge the depth of the water by feeling for its bottom”. Other sources have later defined it as “bottom fishing”, which is not quite the same thing. Whatever it means in Japanese is perhaps not that important so long as we can interpret the hammer candlestick for profit.

What a hammer visually depicts is a market probing for a bottom in prices, deciding that it has found the bottom, and then returning to higher levels. It s a pretty reliable signal of at least a short-term bottom for the market.

Compare the most recent candle on the current chart of the S&P 500 with the diagram above. What do you think? Hammer time?

A candlestick analysis should not be done in isolation. Think of it as just one clue to help you guess where the market is going. Combine it with your other go-to indicators and data points to create a more robust view of how to proceed for the coming days.

SEEN ON THE INTERNETS

On Friday, Frank Cappelleri published an article titled The first two steps of a downtrend on his substack account. It was a summary of the most recent analysis that he provided to his paying clients. However, the main points are quite clear.

What he is seeing is that bullish chart patterns are beginning to falter. And, not coincidentally, possible bearish patterns are appearing.

According to his analysis, the first “successful” bearish target is at 6610 for the S&P 500. If that level is reached, he believes it may turn out to be just the first in a series of bearish breakdowns in the market.

Just last month, we were privy to an online presentation by Cappelleri organized by the CMT Association. In that presentation, he detailed how every potential bearish chart pattern since April had fizzled out. The bulls had been in charge ever since the aftermath of the Trump tariff tantrum.

The bigger lesson here may be the importance of being willing to change your mind when the facts change.

NUMBERS ONLY

- 22.0% | The average stock in the S&P 1500 (the S&P 500, S&P MidCap 400, and S&P SmallCap 600 combined) is down 22% from its high. |

- 4.52% | The Global X Artificial Intelligence & Technology ETF (AIQ) hit an all-time high on Monday but still finished down 4.52% for the week. |

$5.47 billion | The GraniteShares 2x Long NVDA Daily ETF (NVDL) holds $5.47 billion in assets. This is more than the market caps of companies such as Harley-Davidson, Peloton, or Abercrombie & Fitch. |

SWINGEX INDEX

As of market close on: 7 November 2025

|  |

Swingy says: Me and Steph Curry like our threes. Jump in for a quick trade if you see something you like.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

PLTR (Palantir): Palantir as a company stirs strong emotions, both positive and negative. We are not here to debate the merits of the enterprise. We are only looking for stocks to trade.

What we like about PLTR is that the stock is getting rousing support whenever it falls below $175. When the stock gets below that, buyers come in and snap up shares, as evidenced by the long lower shadows on many of those candlesticks.

The support in the low-170s could break if the market takes a turn for the worse. It is already close to officially being a failed breakout. But if we get some sort of relief rally this week PLTR could jump by a handful of percentage points.