- The Prime Wave

- Posts

- One Hundred Plus

One Hundred Plus

The NAAIM exposure index in triple digits

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

The National Association of Active Investment Managers (NAAIM) is a professional organization whose members are typically hedge fund managers and others who actively manage large or institutional portfolios. In other words, the pros.

Each week, NAAIM publishes an “exposure index” quantifying how invested in the stock market its members are. Those members might be using leverage and, therefore, have more than 100% of their capital invested. Or they may be shorting the market, expecting a fall, either with or without leverage. Or, of course, both at the same time.

NAAIM condenses this information into an index number, which you might think of as a percentage of their money invested (long) in the market. Strictly speaking, it doesn’t quite mean this but it is a useful way of thinking about it.

Last week, the index went up over 100. It rarely gets this high and even more rarely stays there for long.

What do you think transpires in the stock market after these occurrences? The pros surely know when to get in and when to get out. Right?

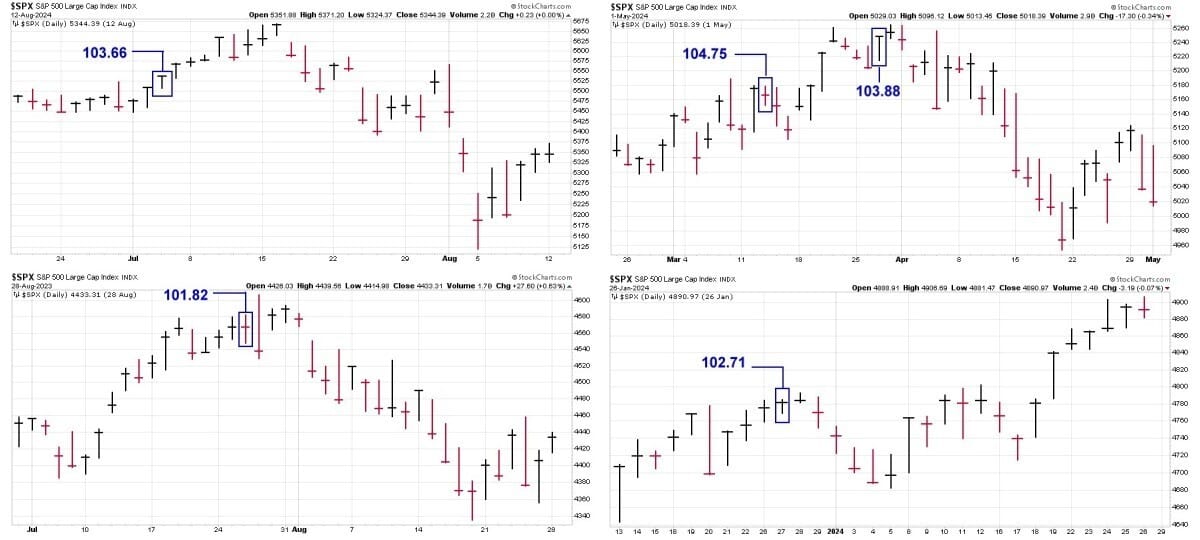

Well here is what happened the last four times the index was up over 100:

Clockwise from upper left: 3 July 2024; 13 & 27 March 2024; 27 December 2023; 26 July 2023

Going all-in does not necessarily mean we have reached the top of the uptrend. But it is probably near. One theory may be that once the professionals are fully invested it takes some time for the amateurs (you and me) to follow along. Or it may simply be that the people with money are out of money.

Before the four episodes charted above, the previous occasion over 100 was a 5-week run from October 27 to November 24 in 2021. That chart is below.

It could be a good time to do some gardening in your own portfolio. Or, if you are strictly swing trading, get yourself in position to take advantage of a likely drop in the market.

SEEN ON THE INTERNETS

This weekend a well-followed investor/trader who goes by “Darvas Box Guru” wrote about some bearish signals appearing in his review of monthly charts.

Specifically, he points out that October saw the highest amount of trading volume on the NASDAQ market ever. You can see that it isn’t because people have been frantically dumping their stocks.

This, combined with other data has pushed him into selling all of his long positions and is now short only. As the author says, “when everyone is in who is left to buy???”.

His typical holding period is measured in months, but it can still be useful analysis for more short-term swing traders.

The speculative frenzy implied by the super high trading volume doesn’t have to end just because we noticed it today. Volume on the NASDAQ has been rising for months and it hasn’t mattered… yet.

It could, and probably will, matter at some point. We just don’t know when. Be prepared for when those speculative urges fizzle out.

NUMBERS ONLY

- 1.75% | The S&P 500 had another positive week and another positive month. The equal-weighted version of the index, however, lost 1.75% last week. |

$4.17 trillion | The total market cap of companies listed on the London Stock Exchange is approximately $4.17 trillion. That is nearly as much as NVIDIA! |

39.8% | Many indexes are at all-time highs, but only 4 in 10 stocks on the NYSE are above their 50-day average price. |

SWINGEX INDEX

As of market close on: 31 October 2025

|  |

Swingy says: Halloween in the jungle is looking scary this year. Stay out of sight and munch on chocolate covered bananas.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

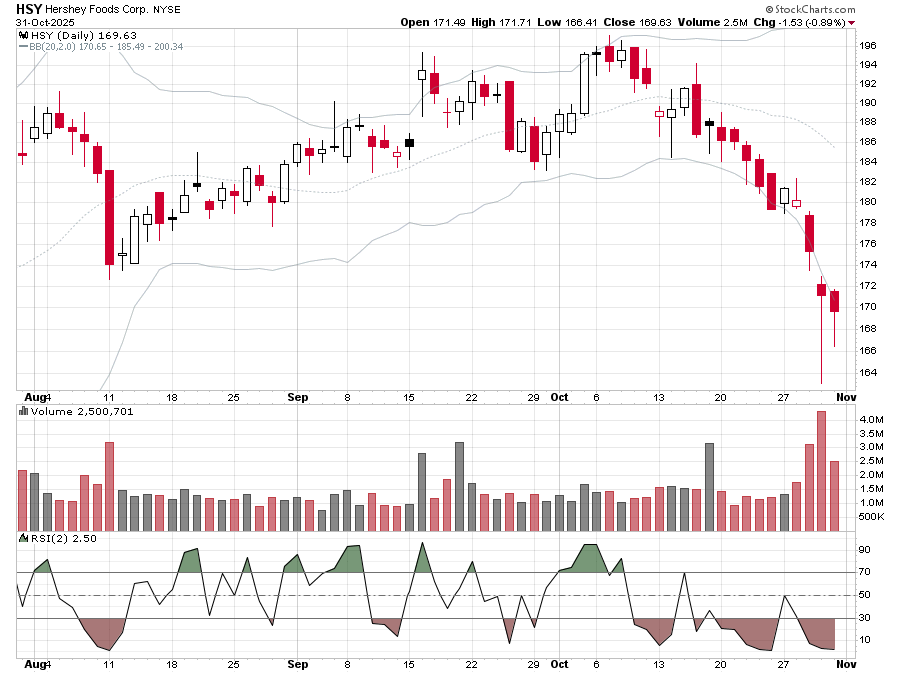

HSY (Hershey Foods): This week we have a reversion-to-the-mean idea for you to consider. Right now, many stocks that are going up are looking tired and fragile. And the stocks going down look like… stocks that are losing value. Here’s one that looks primed for a quick bounce back.

There are four things about the chart for Hershey that look tasty.

The shares have closed below the lower Bollinger band three days in a row. Stocks rarely ever live outside the bands for more than a few days.

The hammer candle on Thursday followed by another candle with a long lower shadow on Friday suggests buyers are coming back at those lower prices.

Trading on Thursday came on a potentially climactic surge in volume.

RSI(2) is down to 2.50 which is a level that usually coincides with at least a pause in a downtrend.

There is not a ton of potential upside here. It does have a high probability of a quick, small win.