- The Prime Wave

- Posts

- Revisiting Tesla

Revisiting Tesla

Imaginary shapes on a chart precede big move higher.

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

Nobody wants to turn The Prime Wave into a Tesla Fan Club newsletter. That won’t happen.

A week ago, this newsletter used TSLA as an example of how different patterns can appear on a chart at the same time. Depending on what visions you may have seen on the chart, the interpretation was that TSLA was either (a) going to make a big move in an unknown direction, or (b) going to go up to some unknown degree.

Well, both of those things have already happened. TSLA went up 12.85% last week.

The financial media always wants to tell you the reason why a stock went up or down. According to Barron’s, TSLA was up because of “inflation data that solidified investors' belief that rate cuts are coming”. Do you really believe that TSLA went up nearly 13% in a few days because more people are expecting a small reduction in interest rates?

A good reading of the chart suggested that the market was looking for a reason - any reason - to move the shares. The interest rate angle provided a plausible story.

Where does TSLA go from here? If you saw a triangle on the chart - which may or may not actually exist - then the classical technical analysis interpretation would imply a price target in the $420 - $425 area.

The way we get there is by taking the triangle’s height of $90 (from $365 down to $275) and adding that to the breakout point. That would be around $330 to $335 depending on how you drew your triangle. That is the green line we added on the chart above. This method may seem comically simplistic, but you would be surprised how often it works out that way.

Coincidentally (or not!), this price target also happens to be where TSLA stalled out last winter.

All of this says that the sudden jump in TSLA shares was possibly not an unforeseeable event driven by the daily news and that there is likely more upside to come.

SEEN ON THE INTERNETS

On Saturday, this post from Barchart on social media caught our attention. That’s probably because the first word in the post was an all-caps “BREAKING” followed by a siren emoji. 🙄

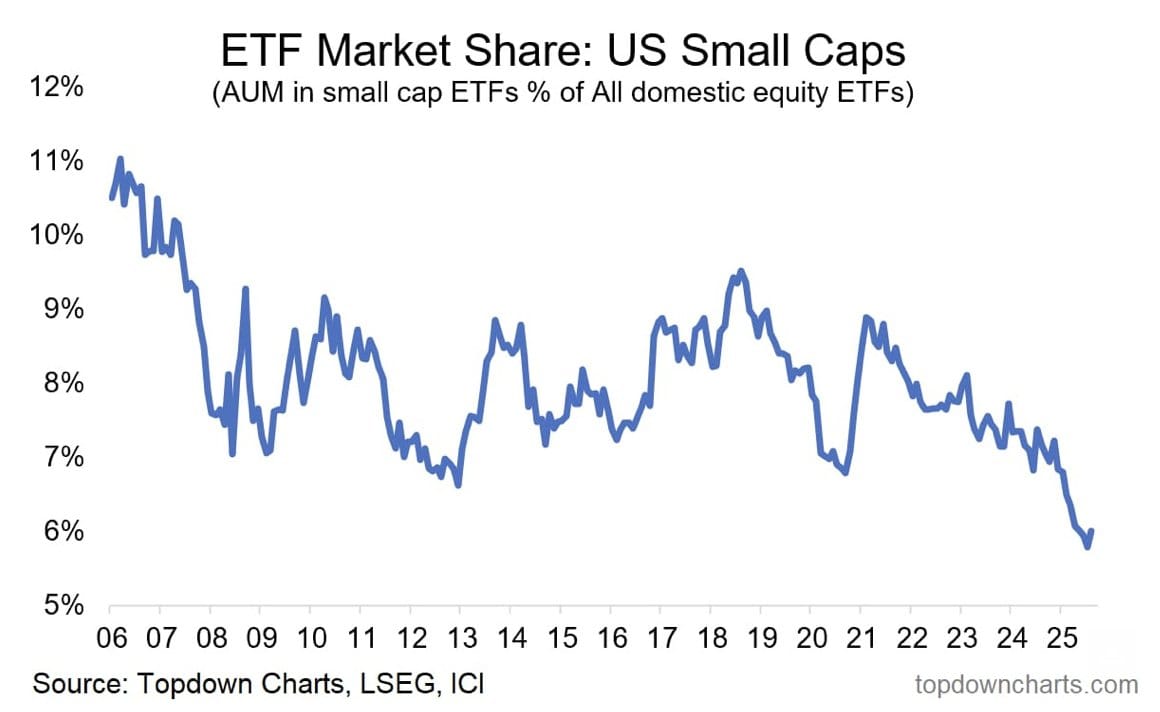

They were sharing some information collected by topdowncharts.com which shows that small cap stocks are historically under-owned. The implication is that these stocks are due for a rebound to get back to their long-term average.

Maybe the “BREAKING” alert was in jest. According to the chart, it would appear that small caps have been repeatedly reaching new lows in “market share” throughout 2025. The same chart in January would have told us the same thing.

It could be true that small cap stocks will go on a powerful rally. But when? Just because you and I notice some anomaly today doesn’t mean the market is going to immediately correct itself.

NUMBERS ONLY

24 | The S&P 500 has reached an all-time high 24 times so far this year. |

21% | In a 3-day period ORCL rose by $104 then fell $53 and now stands at $292. The end result is a gain of 21%. |

3 | On 3 different days last week, the S&P 500 closed higher despite more of its member stocks going down than going up. |

SWINGEX INDEX

As of market close on: 12 September 2025

|  |

Swingy says: The index is neutral and the market wants to go up. Go with the market.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

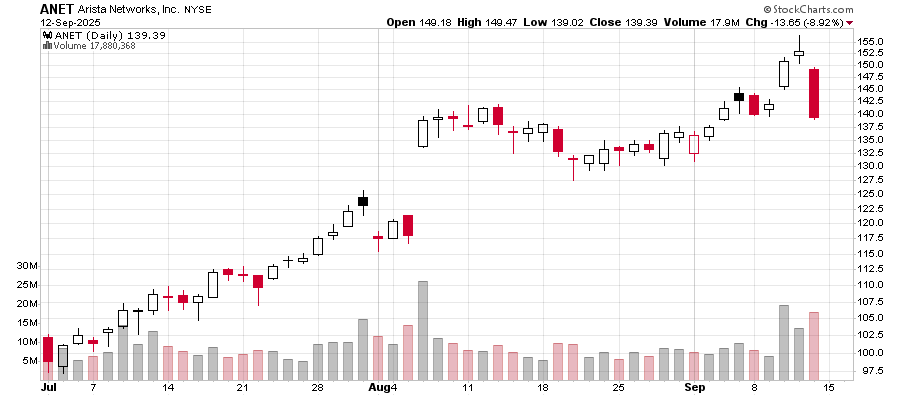

Arista Networks (ANET): This portion of The Prime Wave usually features a stock with near-term upside potential. Today we will look at a stock with a bearish setup.

Over the last three sessions, ANET has printed an “evening star” candlestick pattern. There was a big move up on Wednesday, seemingly breaking free of the base of the previous month or so. Then a day of indecision. The stock covered a range of $6 but ended up only a little higher than where it started. Finally, a gap down on Friday amounting to an 8.9% loss.

The pattern strongly suggests more downside to come. It’s not out of the question that ANET could sink another 10% from here in the near future to $125.