- The Prime Wave

- Posts

- Scary Good

Scary Good

The market is howling!

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

When the stock market doesn’t do what it is supposed to do, that can be meaningful information of its own.

September is statistically the worst month for the stock market. October is not much better and has a history of dramatic crashes.

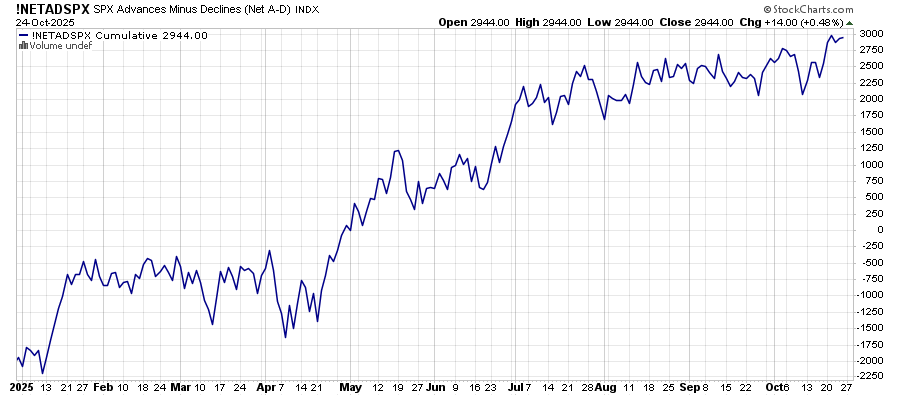

This year, though, it all turned out pretty OK. Even the roller coaster ride of the last two weeks has many market indexes sitting at all-time highs. Pictured below is the Advance-Decline line for the S&P 500. It went sideways from mid-August to mid-October, which is not ideal. Still, sideways isn’t down.

Money keeps flowing into many - certainly not all - stocks. Downturns don’t last long as people rush back in the door. If these are the bad times, imagine what the good times will be like! There are seasoned traders out there who feel that it is time to go all-in as the market sets up for a spectacular bull run.

Swingex Halloween Party 2025

And yet… there are other respected experts warning us that the current conditions are not going to end well. Bubble! They may be right, but not right now.

In the next section of this newsletter, you will see analysis that says we are on the cusp of a historically strong week and a half period. A bit further down, you see the Swingex Index is not liking something about the current conditions. Neither of them are based on some unbreakable law of the universe. They are only showing us tendencies based on past behavior.

Will greedy spirits take charge of the market? Or will the souls of traders be destroyed by a phantom rally?

The best course of action may be to jump into any dips in the market but don’t be shy about booking any profits.

SEEN ON THE INTERNETS

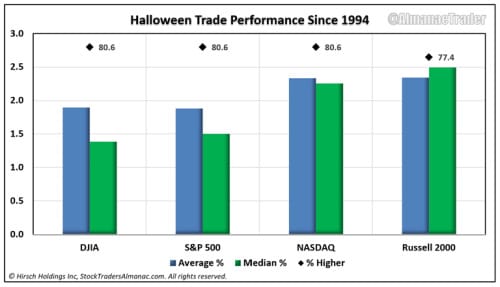

Jeff Hirsch does alot of work on seasonal trends in the stock market and posts some of it on Tumbler (yes, really, Tumbler) as Almanac Trader. A couple of days ago he posted this interesting swing trade idea.

The idea is simple: historically, the last 4 trading days in October and first 3 of November have been quite bullish. So go for it for the next 7 days! The results are summarized in the chart copied below.

In the same post, Hirsch gives us the year-by-year results for those who are more curious. Interesting that two of the last three years have not worked out for this trade even as it has solid long-term results.

NUMBERS ONLY

4.02% | The Global X MSCI Argentina ETF (ARGT) was up more than 4% last week, after Argentina’s currency got a bailout from the U.S. The fund is still down 10% YTD. |

- $1.03 billion | Last Monday, the Vanguard Short-Term Bond ETF (BSV) had a net outflow of just over $1 billion. Total assets in the fund are around $39 billion. |

13% | The S&P 500 is up 13% from Inauguration Day through October 24 - in both 2017 and 2025. |

SWINGEX INDEX

As of market close on: 24 October 2025

|  |

Swingy says: That shiny fruit everybody is chasing might be plastic! Don't be tempted!

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

Note: This week we are offering both a trick and a treat!

DASH (Door Dash): In a spooky irony, our “trick” is a company that exists to deliver treats to your door.

There are two things we don’t like here. One is that failed hammer candle on October 17. They often mark bottoms, but it didn’t hold here. The other problem is that the stock is still lingering down around its lower Bollinger band while most of your favorite indexes are tagging new highs.

EXPE (Expedia): If the market is going to continue higher, look for Expedia to be a treat.

The stock has been bouncing around in a range since August. If the hot money has grown impatient with it and moved on, it could be ripe to rip higher.

Also, be on the look-out for a fake-out. The stock may pierce through one of those peach-colored barriers on the chart and then quickly reverse in the other direction.