- The Prime Wave

- Posts

- Teslas and TKOs

Teslas and TKOs

Elon Musk's face turn, or heel turn, and the TSLA chart.

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

Many of us make the mistake of letting our personal opinions and preferences cloud our judgement about trading decisions.

You might be a fan of Elon Musk and all (or most) that he does. You might hate him. Regardless, we are all here to try and make some profitable trades, focusing on a few days to a few weeks into the future.

You might also be one who finds value in chart reading. Or you might believe that it is useless. The subjective nature of it means that sometimes people see what they want to see in the chart.

Today we will look at two different interpretations of a weekly chart looking back a year for TSLA and you can decide which one (or neither) is correct.

Option 1: The triangle

Don’t you see how TSLA shares have been coiling up inside a narrowing triangle all summer? This is something that often precedes a big move in prices. But which way? Usually in the direction of the underlying trend, if there is one.

You might want to say that prices have already broken out of the triangle as of last week, But I would not declare victory yet.

Option 2: The saucer

If you are not for triangles, you might instead see a “saucer” pattern on the chart. This pattern is a cousin of the more well-known “cup and handle” except that prices do not dive down nearly as much in a saucer.

What it represents is a period of consolidation and frustration for shareholders. The usual move out of a saucer pattern is upward, but only after enough traders have lost patience with it and moved on.

What to do? Well, a classical analysis of the triangle would suggest a move of about $90 from the breakout point. A break above could go to $430 or a break below means we could see $230. A saucer pattern does not give away any secrets in terms of price targets. It only points out in which direction to go.

SEEN ON THE INTERNETS

On the Stocktwits website, Christopher Brecher posted the chart copied below.

He describes something we have been seeing alot of lately: stocks that peaked about a month ago and looking shaky at this point. Brecher shows us GE Vernova, but it could be NVIDIA, Microsoft, or many others.

According to Brecher, these same stocks currently appear to be “oversold”. There may be a countertrend bounce before a longer downtrend resumes.

It may partly explain why the Swingex Index (see below) has a tepid but still positive reading as of this weekend.

NUMBERS ONLY

5 | HYG, a popular junk bond ETF, is on a run of 5 consecutive weeks up. This does not happen during times of trouble. |

10.7% | The weekly AAII sentiment survey once again found more bears than bulls (43.4% to 32.7%). The S&P 500 made a new high the day after the numbers were reported. |

- 13.0% | Shares of Cracker Barrel Old Country Store (CBRL) are still down 13% after the introduction and swift “undo” of their new logo. |

SWINGEX INDEX

As of market close on: 5 September 2025

|  |

Swingy says: A plus 1 is nothing to spit at. Just don't get too greedy or the market might throw you out of the game.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

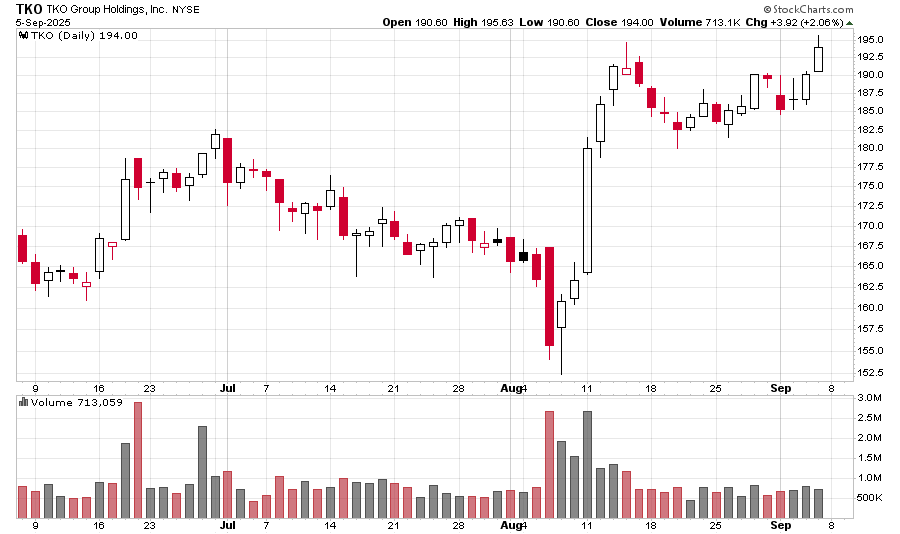

TKO Group (TKO): You don’t have to be a WWE fan to get excited about a stock that just hit a new all-time high. TKO just did that on Friday, but getting there was not always pretty.

The shares had been chopping up and down throughout 2025 and then got a pop last month. The price tagged $190 after falling below $160 just a few days before.

After a healthy consolidation phase, TKO looks ready to continue its ascent. This is a trade that could turn out to be a squash match if general market sentiment holds up well enough.