- The Prime Wave

- Posts

- The ETF Boom

The ETF Boom

When will we be able to create our own ETFs?

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

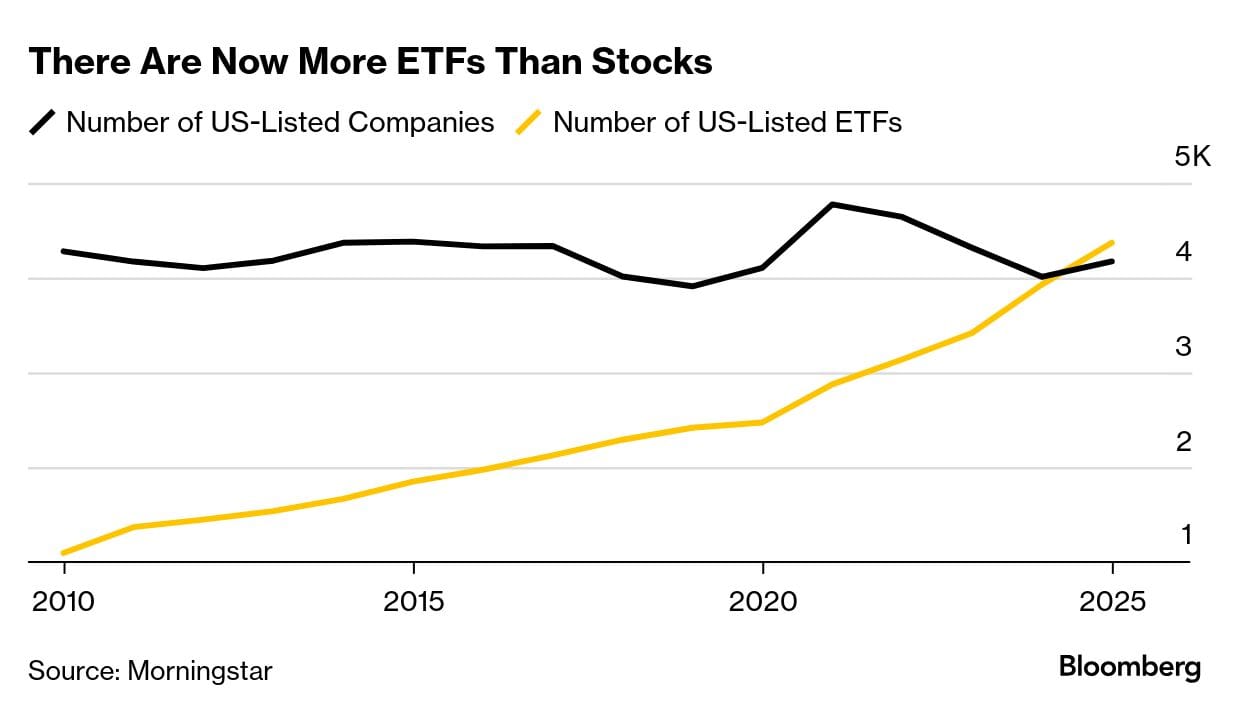

Last week there were some news reports making the rounds about the fact that there are now more ETFs listed on U.S. stock exchanges than actual operating companies.

The general tone is that this is possibly a sign of some terrible consequences ahead for the stock market. That feeling is not universal by any means. As one guest on Bloomberg TV put it “there are more words than letters” so creating numerous variations of baskets of stocks should not be a problem.

All ETFs should not be thought of the same way. Most of the biggest and more famous ETFs invest in a broad range of stocks that are included in indexes like the S&P 500 or the NASDAQ 100. When you buy SPY or VOO, you are buying “the market”. You get a little bit of every stock in the S&P 500 whether you want it or not. The idea is to match the performance of the index.

Most - nearly all - ETFs are not that. Interested in investing in space exploration but don’t know which companies to invest in or how to choose? Try the Procure Space ETF (ticker symbol: UFO). You want to jump on a trend in the pet care industry? There is the ProShares Pet Care ETF (ticker symbol: PAWZ).

These niche ETFs usually hold a small number of stocks and limit themselves to a specific industry or theme.

The biggest limitation to the creation of even more of these funds is a practical one: exchange-listed ETFs are expensive to start and maintain. A hypothetical Swingex Amazing ETF would cost anywhere from $50000 to $100000 just to get to Day 1, according to most estimates.

Starting from these niche actively managed ETFs, its just a small jump to what is known as “copy trading”. In copy trading, you link your account to another account that you covet or admire. When that account makes a trade, it automatically generates the same trade (proportionally) in yours.

The copier doesn’t have to buy a “fund” and can unlink whenever it chooses. The copied account doesn’t have the startup costs of an ETF and gets paid a little something when a linked follower makes a trade. There are few (if any) rules, regulations, or protections with copy trading. Who cares about that?

If the financial incentives work out and there is enough marketing behind it, don’t be surprised if the next evolution in the stock market involves a blurring of the lines between a small ETF and a themed “copy account”.

SEEN ON THE INTERNETS

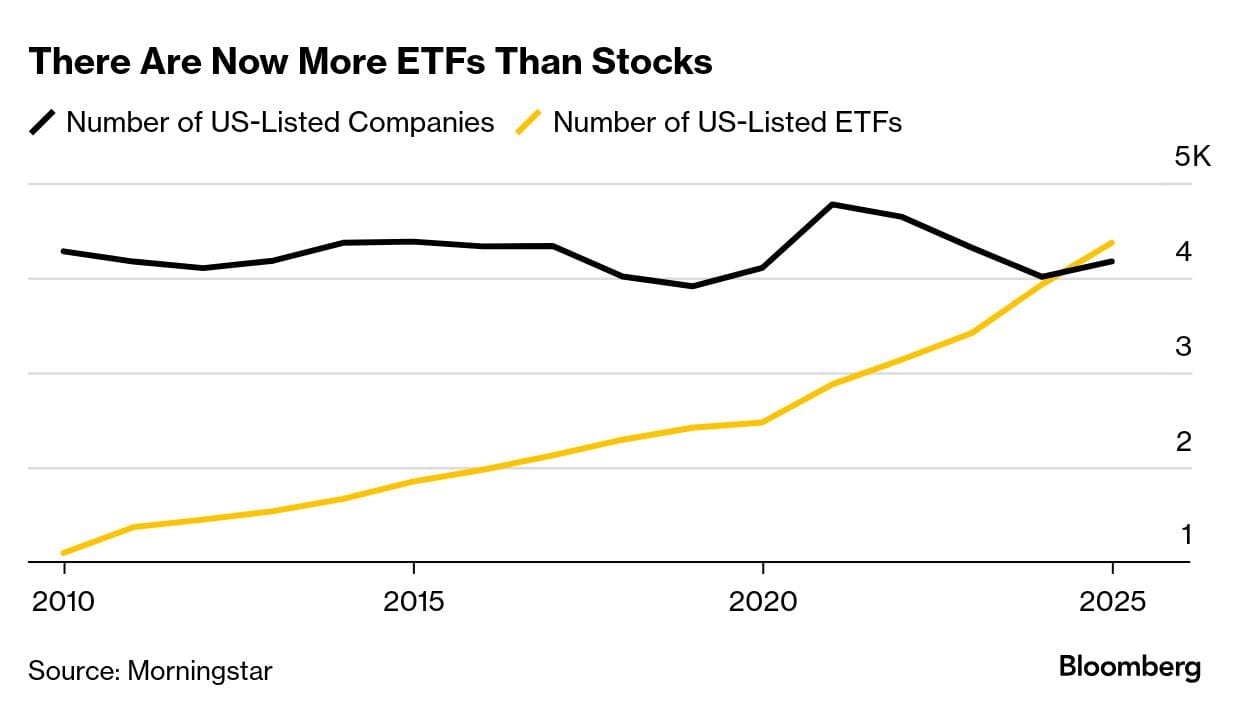

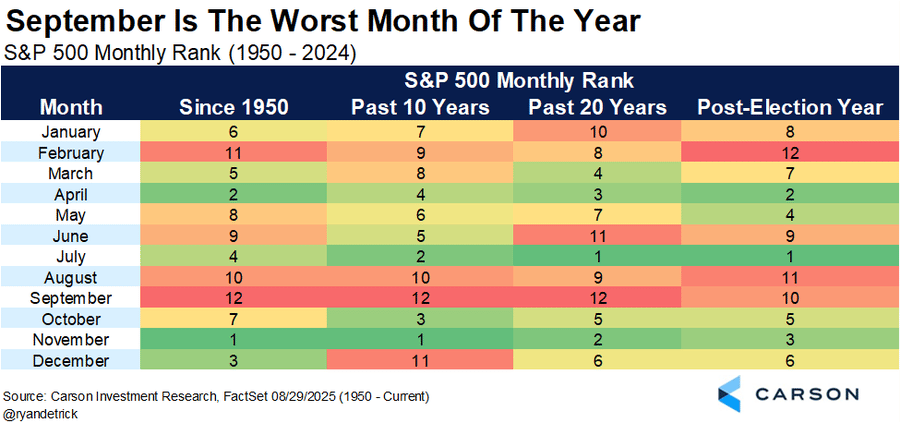

Summer is over and that is often not a good thing for the stock market.

Ryan Detrick, CMT posted the colorful table below on social media late last week. September has historically been the worst month of the year for the stock market, regardless of whether you want to look back 10 years or 20 years or even 75 years.

This doesn’t mean that every September is bad or even that the market will go down this September. It is all a matter of tendencies and probabilities.

OTOH, with many traders knowing the history, a harmless downward move could turn into a panic selloff.

NUMBERS ONLY

- 0.1% | Some zigging and zagging after the Jackson Hole rally left the S&P 500 down 0.1% for the week. More stocks went up than went down, however. |

3 | Only 3 stocks in the NASDAQ 100 reached a 52-week high at any time last week, even though “the market” hit an all-time high. |

2423.24% | Shares of Build-A-Bear Workshop (BBW) are up 2423% over the last 5 years, easily beating the 1224% gain for NVIDIA. |

SWINGEX INDEX

As of market close on: 29 August 2025

|  |

Swingy says: The index is flat neutral and we got a long weekend! Time to chill and enjoy the last rays of summer!

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

Sound Hound (SOUN): Sound Hound mostly rises and falls along with general AI hype. We have no idea if they will become one of the next big things in AI. We just like the chart for a short-term trade.

Looking at the daily chart above, you see a tendency for higher volume on up days, a sure sign of accumulation by investors. You would see the same thing on the weekly chart and even the monthly chart.

The area around $13 seems to be important to traders. If it can get meaningfully above that (it’s now at $13.02) it is likely to continue running higher.