- The Prime Wave

- Posts

- Tired Of Big Tech

Tired Of Big Tech

Money is moving to unloved stocks.

THE BIG IDEA

The holidays are over, and Wall Street has decided it doesn’t love Big Tech stocks anymore.

If investors are pulling some of their money out of the mega-cap stocks, they are not just sitting on the cash. It is being recycled into numerous other stocks.

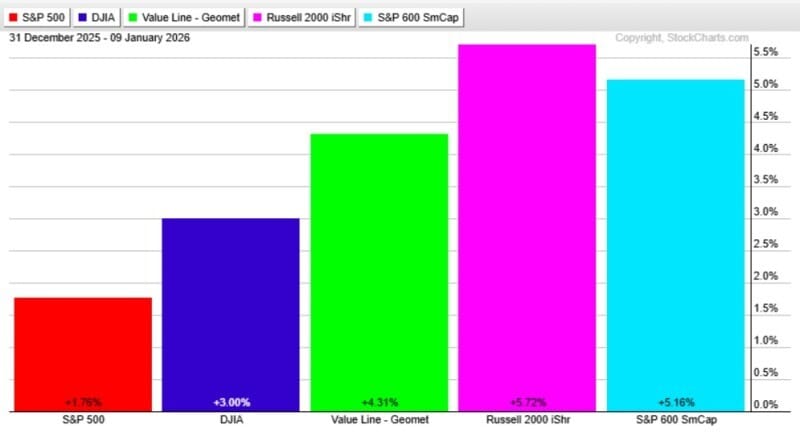

Below we compare the YTD performance of the S&P 500 (red bar) to several other indexes of interest.

Yes, the S&P 500 is up for the year. Money is not exactly flowing out of the market. It’s just that it is lagging behind other indexes. We show here the Dow Jones Industrial Average, Value Line Geometric Index, Russell 2000, and S&P 600 Small Cap Index.

The S&P 500 being a laggard sounds like it should be a bad thing. Is it?

There are two things to keep in mind. First, it doesn’t take that much money to fluff up the values of small cap stocks. The entire market value of all stocks in the Russell 2000 index is about $3.2 trillion. Together, those stocks are still worth less than Microsoft.

The other reason why all of this matters is because of the way the S&P 500 is calculated. The biggest seven companies account for about one-third of the value of the index. As discussed previously in The Prime Wave, NVIDIA counts about 40X more than Starbucks.

When money leaves those Big Tech stocks, it has an outsized impact on the index. (Likewise, when those same stocks are attracting money, it enhances the results.)

So if money is coming out of Big Tech, where is it going? Everywhere! Take a look at this selection of big winners YTD and try to find something they have in common.

Victoria’s Secret (VSCO) +21.65%

Core Scientific (CORZ) +17.72%

Century Aluminum (CENX) +16.62%

Moderna (MRNA) +16.31%

We can only guess whether this is just the market pressing the Reset button to clear up the excessive shift into the mega-cap stocks, or if it is the start of a longer trend.

SEEN ON THE INTERNETS

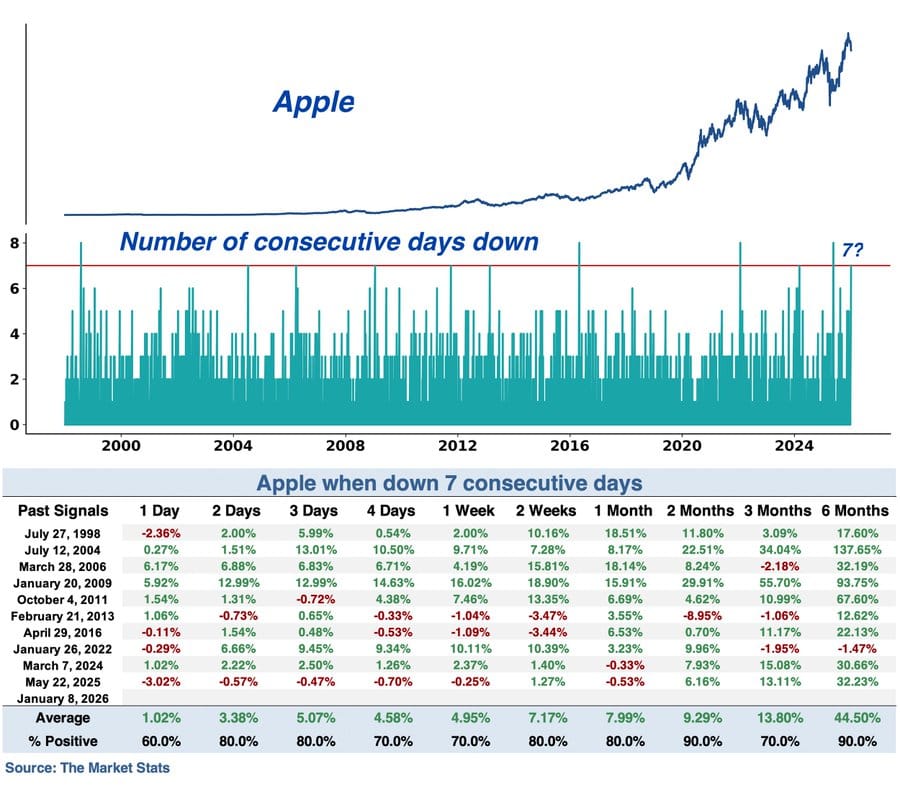

You might have read somewhere that investors have begun shunning Big Tech. Apple is one of those Big Tech losers. The stock is already down 4.59% after the first full week of 2026. According to this post on social media by The Market Stats, AAPL may be so bad it is good again.

Thursday made it 7 down days in a row. Nothing goes straight up or straight down. According to The Market Stats, 7 consecutive down days for AAPL usually leads to a strong rebound within a matter of days. Their numbers are copied below.

Apple broke the streak on Friday with a gain of 0.13%. History says the odds are on your side if you want to do a short-term trade or even hold it for longer.

NUMBERS ONLY

52 | The year has only just started, but already 52 members of the S&P 500 are up by double digits. |

- 33.19% | Remember Netflix? The stock is down by 33.19% from its all-time closing high last summer. |

- 1.62% | Unless you count Kuwait, India is the only major country in the world whose stock market is down so far in 2026. |

SWINGEX INDEX

As of market close on: 9 January 2026

|  |

Swingy says: A bangin' start to the new year and now the index says it is time to rest a bit.

Learn more about how the Swingex Index works here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

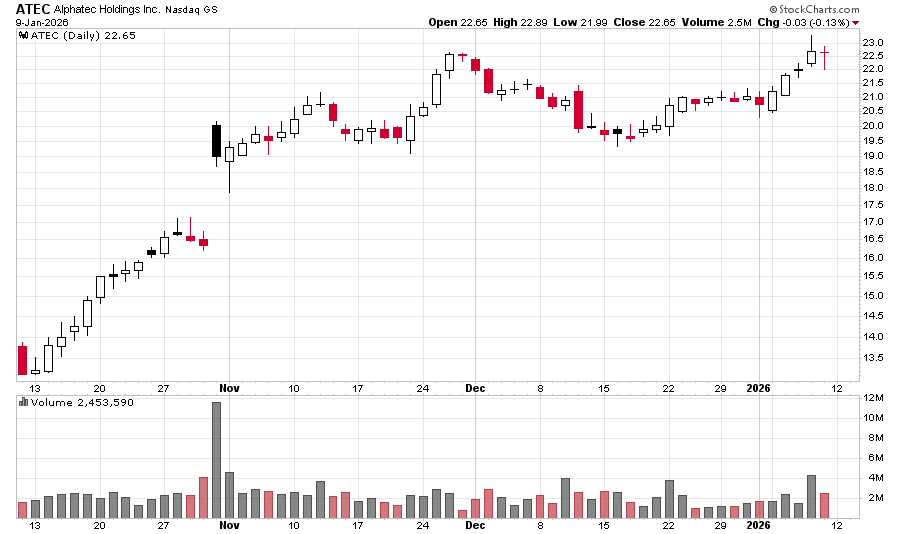

ATEC (Alphatec Holdings): Like the stocks of most other medical device makers, ATEC has started the year well and is teasing a breakout to new highs.

The stock is not overextended at all, as it has been forming a cup-shaped base over the past six weeks. We also like that the higher volume days are all up days. There has been some quiet accumulation of the stock since that previous high in November.

The $22.50 area has been an invisible ceiling for the stock. If/when it can break through, a classical technical analysis reading of the chart would put the next stopping point at $25.50.