- The Prime Wave

- Posts

- Too High Beta

Too High Beta

Rollercoasters go down, but not forever.

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

People like to talk about how “the market” did yesterday, what “the market” is doing today, what “the market” is gonna do tomorrow.

Well that’s nice. But there are a lot of different subsegments of the market, and they sometimes like to tell different stories.

An interesting and, I dare say, fun way of analyzing subgroups is by comparing “high volatility” stocks with “low volatility” stocks. You can easily do this at home via a couple of ETFs:

SPHB: Invesco S&P 500 High Beta ETF

This fund holds the 100 stocks in the S&P 500 with the highest volatility, as measured by Invesco. Top holdings include companies such as NVIDIA, Airbnb, and United Airlines.

SPLV: Invesco S&P 500 Low Volatility ETF

This fund holds the 100 stocks in the S&P 500 with, you guessed it, the lowest volatility, again according to Invesco. Holdings in this group include Coca-Cola, Chubb, and Consolidated Edison.

These are all “S&P 500 stocks” but they don’t necessarily move together. Below you can see SPHB and SPLV side by side since July 1 of this year.

When these two groups get out of sync with each other, it can give us some interesting information. The trick is in figuring out how out of whack things need to get for it to matter.

The way to do it is by taking the ratio of SPHB to SPLV and then applying Bollinger bands to the ratio.

The SPHB:SPLV ratio rarely ever strays outside of the bands. When it does get above the upper band, we should pay attention.

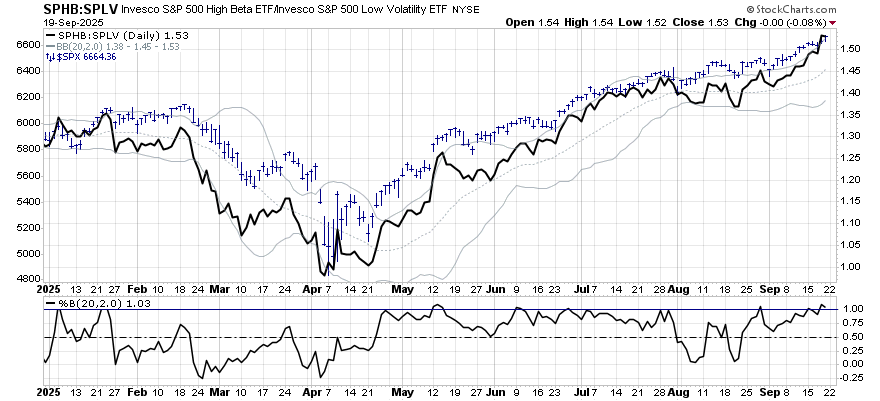

Below we have the ratio in black with its Bollinger bands in grey. The S&P 500 is plotted in blue bars. The ratio is rampaging higher lately because of the opposite-ness of the trends we saw in the two funds.

To see more clearly when the ratio gets above its upper band, we can use the %b indicator which is plotted separately. Values exceeding 1.00 mean we are above the upper band.

The current reading of %b is 1.03 which is actually down a bit from its high point on Thursday.

What often happens is that the excesses get corrected by the “high beta” stocks going down to be more in line with the “low volatility” cohort. It does not have to happen immediately or even be very long-lasting.

The condition of the ratio right now is telling us to expect a sharp jolt lower in “the market” led by stocks with higher volatility. But don’t panic! It’s probably not the first step of a long decline.

SEEN ON THE INTERNETS

What we seen on the internets this week is a little different.

First, there is this cry for help in r/Trading on Reddit. It is a wannabe trader who has been searching and searching and searching for an acceptable trading system they can use. For some reason, this person has ignored the Buy and Sell buttons and instead invested all their time and mental energy evaluating trading systems they found elsewhere around the internets.

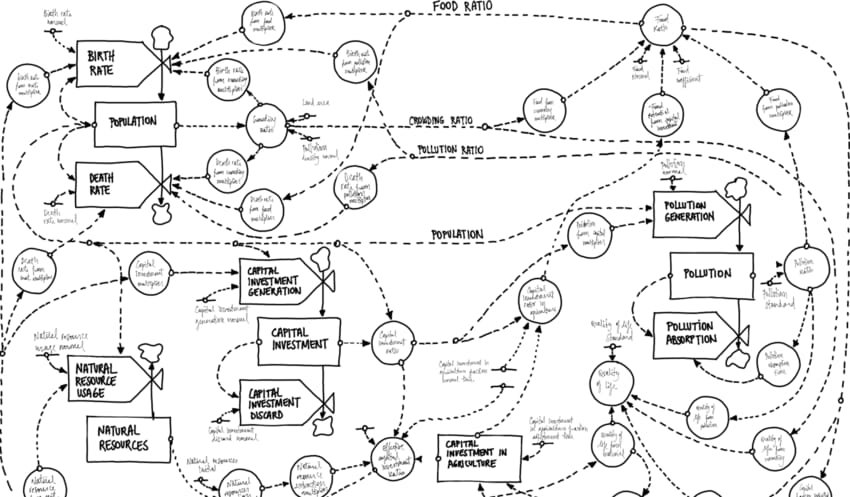

Shortly afterward, we seen an article titled Magical Systems Thinking on the Works In Progress website.

The article itself is not terribly long. Yet, it manages to cover several concepts: Le Chatelier’s Principle, Gall’s Law, and the Beer Game.

Jay Wright Forrester’s economic model

The main point of the article is that good complex systems tend to evolve from good simple systems. Designing a complex system from a blank sheet of paper rarely ever works.

I can’t say for sure, other than from personal experience, but most sophistimacated trading strategies probably started out as simple ideas that were refined and enhanced over a long period of time.

NUMBERS ONLY

967 | The Russell 2000, via the $IWM ETF, reached an all-time high on Thursday. It came 967 trading days after the previous high. |

$10050 | According to Ramp Capital, if you had invested $10000 in Intel (INTC) 25 years ago, it would now be worth $10050. |

159.8% | The best performer in the S&P 500 so far this year? Seagate Technology, up 159.8%. |

SWINGEX INDEX

As of market close on: 19 September 2025

|  |

Swingy says: Another donut. Have a beer with your donut to celebrate your winnings. But be cautious with new trades.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

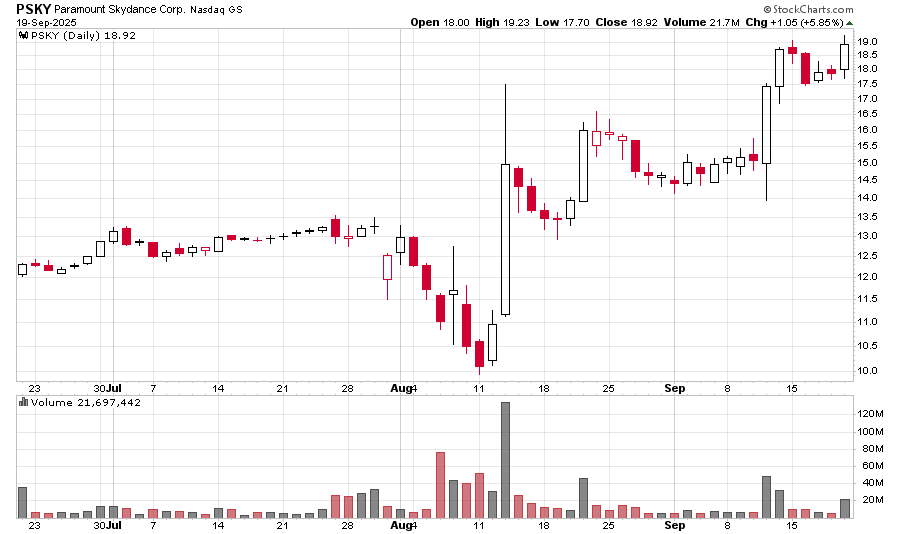

Paramount Skydance (PSKY): The merger of Paramount and Skydance is a thing now, and the market seems to approve. Your mission, should you choose to accept it, is to figure out where the stock goes from here.

It is hard these days to find a stock with a good setup that isn’t too extended. At least PSKY is verging on breaking out of a mini-base even if it is only a week long.

What is striking about this chart is the repeated surges in volume since the August merger, which push the shares higher. The fourth one of those just happened on Friday.

It is not impossible for PSKY to jump over $20 in the short run. Even if it stops there, that is still a 5% gain in potentially a matter of days.