- The Prime Wave

- Posts

- Watching Junk

Watching Junk

Junk bonds have something to tell us about the stock market.

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

You might figure that high yield bonds, what you and I call “junk bonds”, would have nothing to do with the stock market. These are bonds, not stocks. Why should we care?

We should care because high yield bonds can function something like an early warning system for changes in the stock market. Although they are bonds, their value tends to rise and fall along with the stock market. More importantly for our purposes today, when the speculative “hot money” starts to dry up you can see it more clearly in the junk bond market.

Below we have charts of the S&P 500 and HYG, the iShares High Yield Corporate Bond ETF. There is also a horizontal plotted at the current value for each, to help compare the two charts.

If you focus on the last few bars of each chart, you might notice that the junk bonds didn’t bounce back with the same vigor as stocks did on Friday.

Looking back a little further into the past, you will see that HYG is now at the same level as it’s high point on Friday, September 5th. The high for the stock market that day was 6532, or 111 points below the current level.

So there are signs that the bull market in junk bonds is stalling out. What would that mean for the stock market?

It can be that the speculative money will simply move into more defensive stocks. Or it can leave the market altogether. Or a little of both.

It is too early to head for the lifeboats, but it is a situation worth monitoring in the days and weeks ahead.

SEEN ON THE INTERNETS

The biggest development in the stock market last week was the 3-day drawdown. It was the first 3 day losing streak in more than a month.

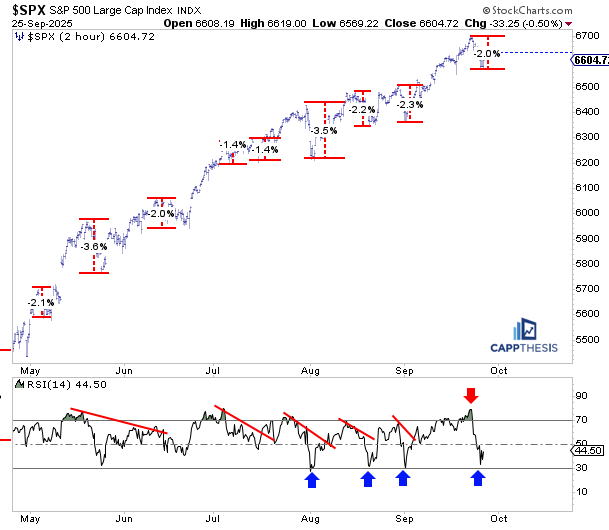

And so we were interested by this post on social media by Frank Cappelleri.

Posted after the market closed on Thursday, he pointed out that the 3 day decline had already become an “average” pullback. (If you have already forgotten, the market bounced up on Friday.)

Also interesting is his use of a 2-hour chart. It is not common which means it is probably useful. Note to self.

He shows us in the bottom panel that the 14-period RSI on a 2-hour chart has been bottoming out at or near 30 on several of these dips in recent months. Will it hold true again this time?

NUMBERS ONLY

4.81% | Energy stocks, as represented by the XLE ETF, had a solid week going up 4.81% while most of the market was down. |

5 | Shares of Expedia (EXPE) are on track for their fifth consecutive up month. If a recession was coming, you might expect to see it show up here. |

20.2% | A little more than 1 in 5 stocks in the S&P 500 are currently sitting at either a 1-month low or a 1-month high. There are many in each group. |

SWINGEX INDEX

As of market close on: 26 September 2025

|  |

Swingy says: The mania for AI stocks is cooling down. ChatGPT told me so. The index stays neutral.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

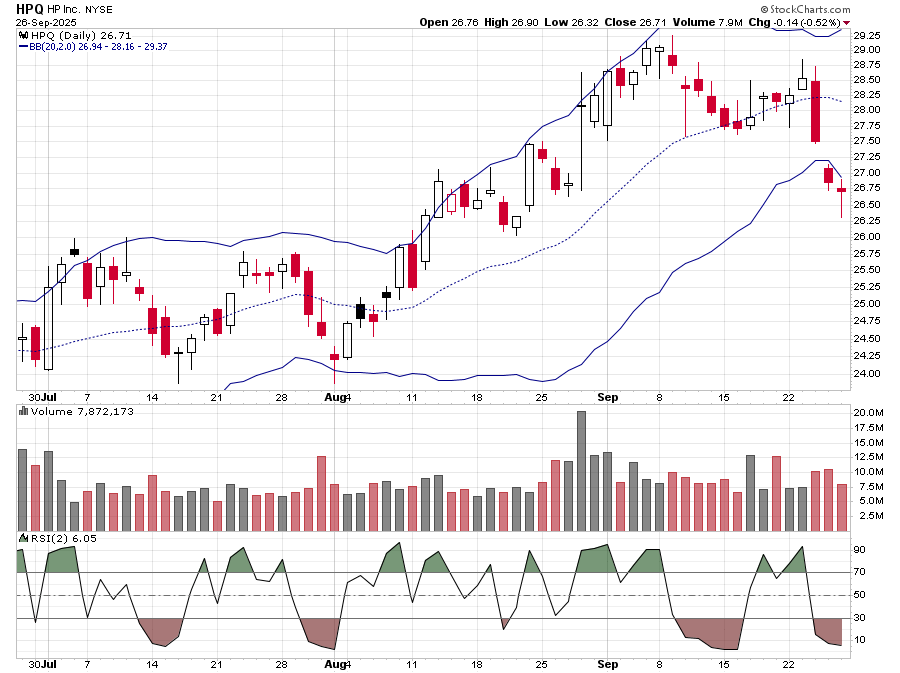

HPQ (HP Inc.): The company formerly known as Hewlett-Packard had a rough few days last week. The shares closed at $28.53 on Tuesday and finished the week at $26.71. That’s a 6.4% loss in three days. It could be ripe for a swing trade back in the opposite direction.

What we like about the chart is that HPQ spent the last two days fully outside its Bollinger bands. Often times this leads to a reversal or, worst case, a sideways type of move. On top of that, Friday’s trading generated a hammer candle on the chart which is a well-known bullish setup.

We also included a plot of the 2-period RSI indicator. When RSI(2) gets into single digits, as it is now, it frequently marks a short-term bottom.