- The Prime Wave

- Posts

- Who's Buying?

Who's Buying?

And can they, will they, continue?

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

“the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance”

The statement quoted above, so clearly provocative and titillating, caused thousands of people around the world to simultaneously press the Buy button on their computers, smartphones, and Bloomberg terminals.

On numerous occasions recently, really any time Powell would speak in public, he described the Fed’s interest rate policy as being “moderately restrictive”. He did so again at Jackson Hole, literally immediately before uttering those quoted words.

You can read the text of the Chairman’s speech on the Federal Reserve’s website.

Anybody who has been paying attention understood that talk of shifting and adjusting meant a lowering of interest rates. At least the short-term rates that the Fed influences. So it seemed like a good time to buy stocks, especially stocks of companies that borrow lots of money.

Now there are two questions:

Who was buying?

How much more money do they have?

It probably was not the professional fund managers who were buying. The latest NAAIM Exposure Index came in at 98.15. It can sometimes go over 100, but usually not by much and not often. The pros are just about as fully invested in the market as they ever get.

What about us pathetic individual investors? The weekly AAII sentiment survey has for several weeks now found more bears than bulls among its members. Could be that it was retail traders fueling the Jackson Hole rally on Friday, if some of those bears had decided to switch sides.

The website Stocktwits likewise publishes a sentiment indicator, updated daily. Stocktwits users are equally as sophisticated as AAII members but more actively engaged in the daily ups and downs of the market.

As of Friday, these traders remained bullish but sentiment drifted a bit towards neutral. They probably were not the key group coming into the market with fistfuls of dollars.

So we have AAII members leaning bearish and Stocktwits users leaning bullish, but neither are at extreme levels. Hard to draw any strong conclusions from them.

The pros, though, are close to fully tapped out. They will need to have more money become available to them, and soon, or the Great Jackson Hole Rally may fizzle out.

SEEN ON THE INTERNETS

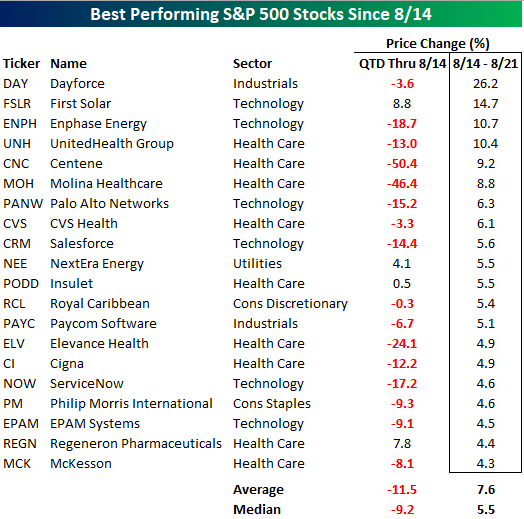

Before anything newsworthy happened in Jackson Hole, Bespoke Investment Group pointed out that some stocks that had been bad were suddenly good again. A link to the original post is here.

Looking at the best stocks for the week from August 14 through August 21, many of them had been down by double-digits so far in Q3. Healthcare stocks have been hit especially hard.

What was not said in their post is that the opposite is also true. Many of the best stocks this summer peaked either near the end of July or the first week of August.

NUMBERS ONLY

- 0.90% | Despite the rally on Friday, the NASDAQ 100 (home to all of your favorite mega-cap tech stocks) was down 0.90% for the week. |

51.2% | Even after a down week, VNM, an ETF following the Vietnamese stock market index, is still up 51.2% for the year so far. |

0 | On Friday, there were no new 52-week lows among the S&P 500 stocks, or the NASDAQ 100, or the Dow Jones Industrials, or the Dow Jones Transports, or the Dow Jones Utilities. |

SWINGEX INDEX

As of market close on: 22 August 2025

|  |

Swingy says: The index isn't buying the 'rebalance' talk from Jackson Hole. So I'm not chasing the rally that ensued after Powell's speech.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

Rush Street Interactive (RSI): There are more and more degenerate gamblers born every day. Rush Street is a beneficiary of that, especially from their Latin American operations.

What matters more to us is the chart. After a jump on earnings, RSI formed a base during the first 3 weeks of August. It is starting to move again and looks likely to continue higher in the short run, at least. Consider jumping on this momentum play for a swing trade.