- The Prime Wave

- Posts

- You Are Here

You Are Here

Should you be somewhere else?

THE BIG IDEA

A few months ago I was in my local supermarket when I noticed that a product I intended to buy had the words OPEN HERE printed rather conspicuously on the package. It seemed like a strange thing to do, to open it right there in the supermarket, but I hadn’t ever bought it before. So what do I know? I’ll follow the instructions.

TL/DR: The manager also thought it was a strange thing to do.

It seems that wherever I go I am always “here”.

Considering the time of year, here is another deep thought for a chilly winter Monday:

Getting back to being “here”, we have established that we are already here but are we in the right place in the market?

If you have been sticking with the big names, you have been living well for the last few years. But now Apple is down 13% in two months. Microsoft is down 14% from the top three months ago. Even fan favorite NVIDIA has not done much since last summer.

This year began with 14 consecutive days where the Russell 2000 index of small cap stocks outperformed the S&P 500. We aren’t talking about simply a 14-day period where small stocks were the leaders. Literally each individual day, for 14 days, small stocks were better.

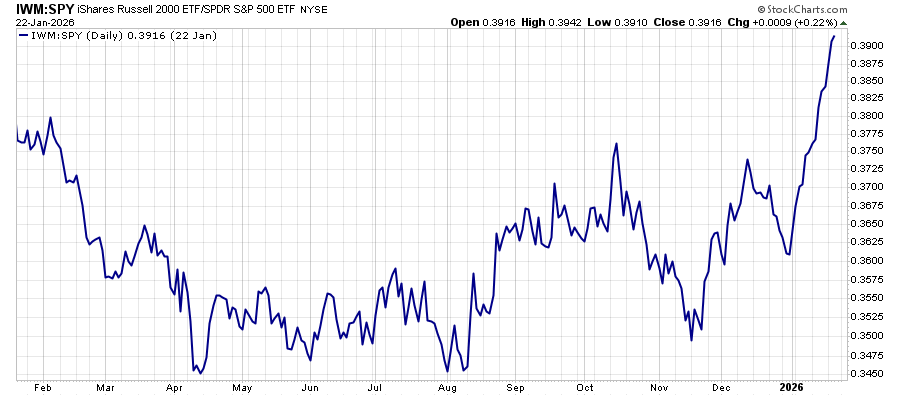

In the chart below, we take a ratio of the Russell 2000 index to the S&P 500. When the line is going up, the small stocks are doing better than their larger counterparts.

Things never always go in one direction, and the streak was decisively broken on Friday.

So now the big question is whether this new love of smaller stocks is just a passing fad or is it the place to be for the foreseeable future? Many analysts have an opinion, but nobody really knows anything. Nobody was pounding the table in support of small stocks a few weeks ago.

Regardless of what happens, it wouldn’t be the worst thing to start getting involved with shares of some less-known companies.

If you need a few smaller names to round out your portfolio or to jump into for a swing trade, you could take a look at the four below. All have market caps of merely a few billion dollars, all are up for the year, and all are interesting for different reasons.

(Astute readers of the Prime Wave will recognize the recent shooting star for Guardiant Health. Proceed accordingly with that one!)

If where you are with your portfolio hasn’t been working lately, consider finding a new “here”. It might be the best move you make all year.

SEEN ON THE INTERNETS

Most people (admittedly including the Prime Wave) tend to talk about “tech stocks” as if they were a monolithic group of stocks that all move as a unified group.

In reality, there are a lot of subcurrents that sometimes don’t go with the flow. Lately, it is stocks of software companies getting crushed while other technology-related stocks are doing well.

Below is a chart posted by Bespoke Investment Group, showing the recent price trends for the largest holdings in the popular IGV ETF.

Not only are they all down, but 8 out of 10 are down by at least 6% in the first three weeks of 2026.

Bespoke speculates that this is the “ozempic moment” for software stocks, meaning the market is now reflecting a permanent change in how we perceive software creation in the age of AI.

Will there be a tradable counter-trend rally? Or will the devaluing of software continue?

NUMBERS ONLY

22 | Last Tuesday was the worst day for the S&P 500 since last April. Still, 22 of its members made all-time highs last week. |

- 8.87% | The Roundhill Sports Betting And iGaming ETF (BETZ) is down 8.87% so far in 2026. Bet you didn’t see that coming. |

7 | The “materials” sector, full of old-fashioned companies involved in mining, chemicals, and steel, is on a run of 7 consecutive up weeks. |

SWINGEX INDEX

As of market close on: 23 January 2026

|  |

Swingy says: We dined on TACOs this week, but it's not clear what's on the menu for next week.

Learn more about how the Swingex Index works here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

IBKR (Interactive Brokers): This winter, shares of IBKR have produced a classic cup-and-handle chart pattern. Now the stock has surged above the top of the cup, which is the typical result of this chart pattern.

The two end points of the cup came at an area of strong resistance at $73, going back to earlier in the fall. Why that specific price mattered to IBKR traders is not immediately clear. Now, that price should provide a solid floor in the event of a downturn in the market.

Looking at the chart, you may think you have already missed the train. There is still time to get on board. Based on the depth of the cup, a traditional technical analysis interpretation would put the first stopping point for IBKR at around $85.