- The Prime Wave

- Posts

- What is "the" stock market?

What is "the" stock market?

Pick your favorite measurement.

THE BIG IDEA

Contrary to popular belief, the S&P 500 is not “the stock market”. It might be best thought of as the world’s most popular large‑cap tech index.

This does not stop most of us (including, ahem, swingex.com) from referring to it as the official benchmark for the stock market.

What’s wrong with the S&P 500 as an index? Well, a few things.

Heavy concentration in mega‑cap companies - because the index is weighted by market cap, the largest companies dominate. Currently, just 10 of the 500 members account for around 40% of the index.

The rich get richer - the cap-weighted aspect of the index also means that stocks that are performing well count more in the index. Conversely, stocks going through a rough period will have less influence. So the index itself is biased towards stocks that are going up.

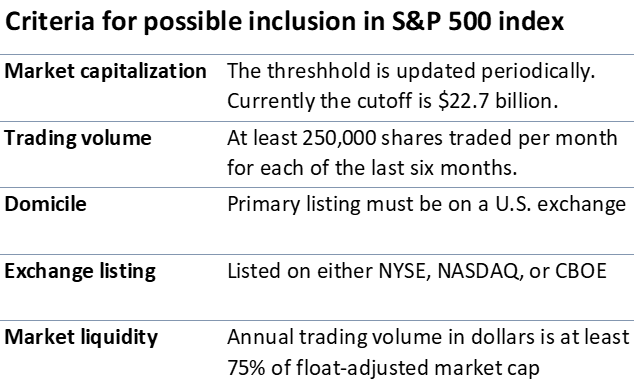

Emerging companies and industries are absent - there are rules for inclusion in the index (see accompanying table) which tend to prevent up-and-coming companies or entire industries from making it into the index.

There is also a profitability requirement for a company to be added to the index, though they don’t have to remain profitable afterwards.

What about some other indexes? Here are a few:

Equal-weighted S&P 500 - still the same 500 stocks, but each one counts 0.2% toward the total. This solves the first two issues cited above.

Russell 3000 - includes the 3000 largest companies incorporated in the U.S., approximately 98% of the total value of all possible stocks. However, it is a cap-weighted index, just like the S&P 500.

Wilshire 5000 - includes “everything”, which is actually less than 5000 stocks. It is also a cap-weighted index.

Value Line Arithmetic Index - an equal-weighted index that includes all stocks covered by Value Line. That works out to around 1700 stocks, give or take.

Value Line Geometric Index - covers the same stocks as the Value Line Arithmetic Index, except it is calculated to approximate the performance of the median stock,

How do these indexes look one month in to the new year? Here are the results:

Symbol(s) | January 2026 | |

|---|---|---|

S&P 500 | $SPX or SPY | + 1.37% |

Equal-weighted S&P 500 | $SPXEW or RSP | - 0.31% |

Russell 3000 | $RUA or IWV | + 1.50% |

Wilshire 5000 | $FTW5000 or $W5000 | + 1.55% |

Value Line Arithmetic | $VLE | + 3.71% |

Value Line Geometric | $XVG | + 3.09% |

( Some data sources use a ^ instead of a $ to indicate an index. )

You can see that in just one month there can be quite a range of results for “the stock market” depending on what you include and whether you give more weight to larger companies.

Notice anything missing? We did not include the once-standard Dow Jones Industrial Average (ask your grandparents). It is only 30 stocks, all very mature companies, and the index is weighted by the price per share. Not a fantastic way of capturing the condition of the stock market.

SEEN ON THE INTERNETS

Last week’s Big Idea discussed whether the recent surge in small cap stocks had some legs to it or was simply correcting some excessive love for the Mag 7 stocks. (ICYMI: You Are Here)

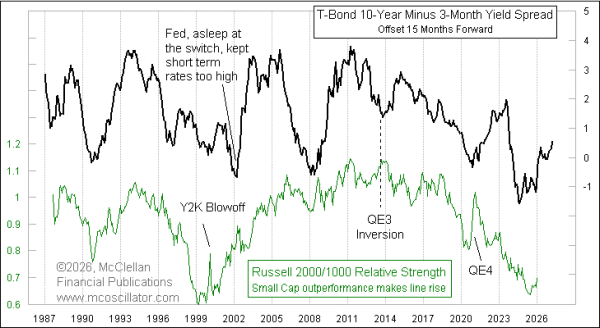

This week, Tom McClellan covered the same topic from a different angle. His latest Chart In Focus article is titled Steepening Yield Curve Good For Small Caps.

It’s best that you read the article for yourself. However, the gist of it is that when the yield curve is getting steeper, which it has been doing for a while, then it eventually leads to a strong period for small cap stocks.

It is not a perfect correlation, obviously. Other conditions or external events can throw off the relationship.

As it stands now, McClellan sees small caps as the place to be for at least the next 15 months.

NUMBERS ONLY

- 10.66% | In the two days since Microsoft reported earnings last week, MSFT has plunged by 10.66%. |

3 | On Friday, three members of the Dow Jones Industrial Average hit all-time highs. Congratulations to Caterpillar, Chevron, and Coca-Cola. |

$3 trillion | A proposed mega-merger of Elon Musk’s Tesla, SpaceX, and XAI would make the combined company worth $3 trillion, according to some estimates. |

SWINGEX INDEX

As of market close on: 30 January 2026

|  |

Swingy says: There's been a bunch of zeroes lately. It's beginning to look like a MAGA rally!

Learn more about how the Swingex Index works here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

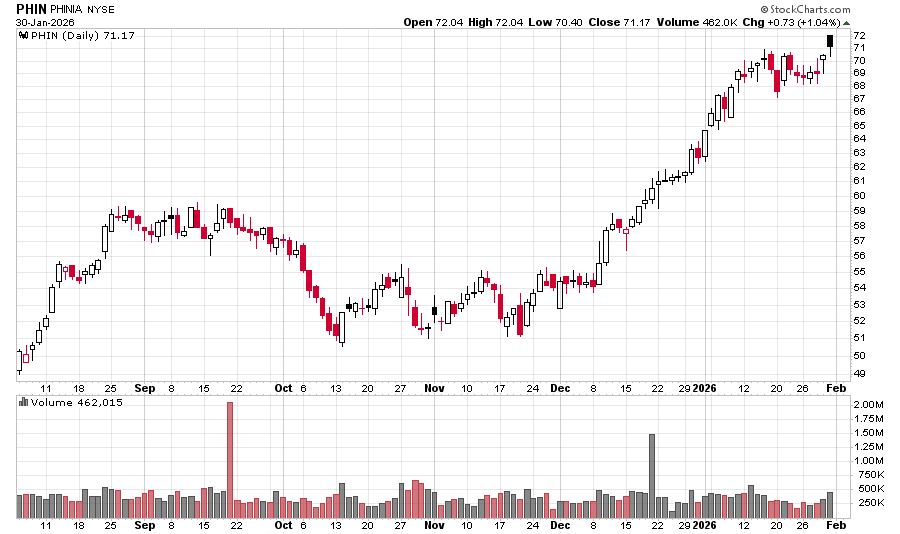

PHIN (PHINIA): You probably don’t recognize the name. PHINIA is a 2023 spinoff of the automobile parts business from BorgWarner, which is also not familiar to alot of people.

The chart contains an interesting history.

A strong run in August settled into a flat base, which would be more likely to resolve higher. Instead, the opposite happened and PHIN dropped into a longer and deeper base, lasting until December.

And then another uninterrupted leg higher followed by another, though shorter, base. Some chartists might reasonably call it a bullish pennant.

In any case, the stock appears to have embarked on the next step higher on Friday. You can catch it early. Just remember that tendencies are not guarantees and there is always a chance of failure. PHIN last autumn was an example of that.