- The Prime Wave

- Posts

- 2% Fridays

2% Fridays

What happens after a big down day on a Friday?

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

On Friday morning, word came from Norway that Maria Corina Machado had received the Nobel Peace Prize for “her tireless work promoting democratic rights for the people of Venezuela and for her struggle to achieve a just and peaceful transition from dictatorship to democracy”. (press release: link)

A few hours later, and completely unrelated to that, POTUS threatened some attention-grabbing new tariff rates on goods imported from China.

The stock market was not in a mood for tacos and sold stocks for a 2.71% fall. Truth is, the market was primed for a sharp drop and the tariff news was the excuse the market was waiting for to start selling. But whatever the reason for it, we still have to try and figure out what happens next.

It seems possible, even likely, that a big down day on a Friday would lead to some kind of shenanigans on the following Monday. That’s what we focused on - what happens after a 2% or more drop on a Friday.

It has happened 62 times in this century. As much as we tried, the data just didn’t have many secrets to reveal. There is one, and we will save that for the end. 🙂

Here is what we found:

A big gap at Monday’s open - either up or down - is not much more likely than any other Monday.

If there is a big gap, the market is just as likely to reverse as it is to continue in that direction.

Monday’s performance from open to close is a dead heat: 31 up and 31 down.

If we look at the whole week, from Monday’s open to Friday’s close, it looks pretty ordinary on the surface. The average gain is 1.00% and the median is 1.03%.

But there is one thing you should know about the week to come.

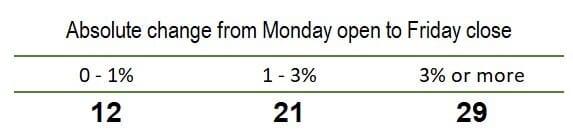

That last bullet point, we cited the average and median. However, there are some really violent swings in both directions. If we look at the absolute change for the week and don’t worry about which direction, the numbers tell a different story.

The historical data does not offer much guidance on whether the market goes up or down this week. The one thing we can look out for is a wild ride between now and Friday.

(Note: As we queue this up for publishing, S&P 500 futures are indicated to open about 1.5% higher.)

SEEN ON THE INTERNETS

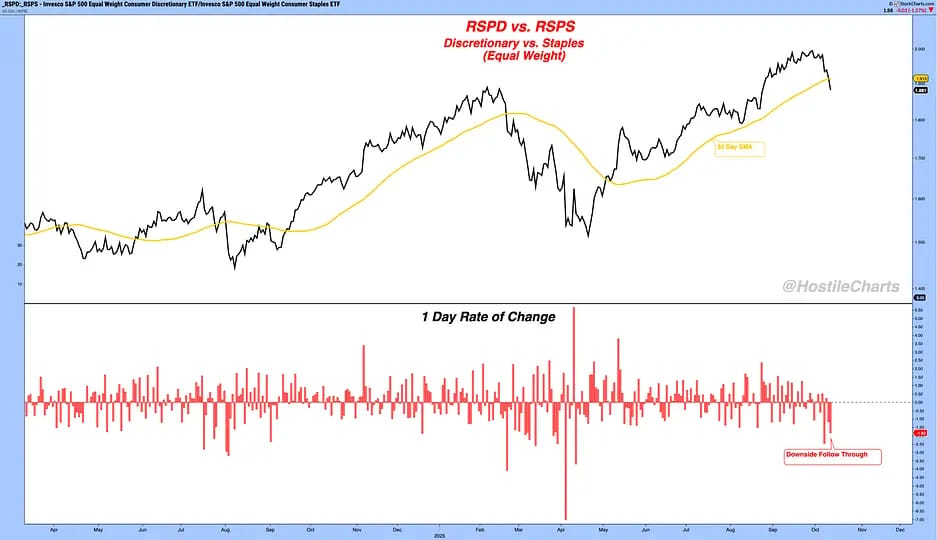

This weekend, Larry Thompson, CMT (a.k.a. HostileCharts) posted the chart copied below on the Stock Twits website.

He is comparing Consumer Discretionary stocks to Consumer Staples stocks. When the line is going up, it means Consumer Discretionary is performing better than Consumer Staples.

The theory connected to it is that in times of trouble people will continue buying bread and toilet paper but might cut back on their latte consumption. So its Starbucks down and Kroger up (or at least down less).

Thompson’s brief comments finished with “This looks different than August....”.

He is referring to the brief market scare at the beginning of August, we think. The ratio of Discretionary to Staples did not fall as much at the time and did not break through its own moving average as it did on Friday.

NUMBERS ONLY

19 | Despite the selloff, 19 stocks in the S&P 500 closed at a 1-month high on Friday. |

- 4.78% | The Invesco S&P 500 High Beta ETF fell 4.78% on Friday. This is much worse than the rest of the index but entirely expected for a fund full of the most volatile stocks. |

$79.95 | The iShares High Yield Corporate Bond ETF (HYG) closed at its lowest value since September 2. We mentioned the importance of those bonds two weeks ago in Watching Junk. |

SWINGEX INDEX

As of market close on: 10 October 2025

|  |

Swingy says: You might nibble on some tacos and beer, but don't gorge yourself yet!

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

MP (MP Materials): The company mines “rare earth” minerals, a hot topic these days. You might think the company’s shares would be caught up in a speculative frenzy. In reality, MP is only now finishing a technically solid base.

For two months the stock has traced out an inverted head-and-shoulders pattern. If it does what it “should” do, we can expect a break to higher prices.

It started to happen on Friday. Then it fell back to Earth as the whole market sold off. Look for it to try again if/when the mood of the market lightens up.