- The Prime Wave

- Posts

- Zooming Out

Zooming Out

Where to go when you don't know where to go.

The Prime Wave is a free weekly publication intended for active traders and those interested to learn more about trading. If this has been forwarded to you, you can subscribe here to continue receiving the newsletter.

THE BIG IDEA

There is a pithy saying among traders: when in doubt, zoom out!

We are all here for short-term swing trading. Still, it is never a bad idea to stop and look at the big picture. That is especially true in times like this, when the market is volatile during the day and ends up not far from where it started.

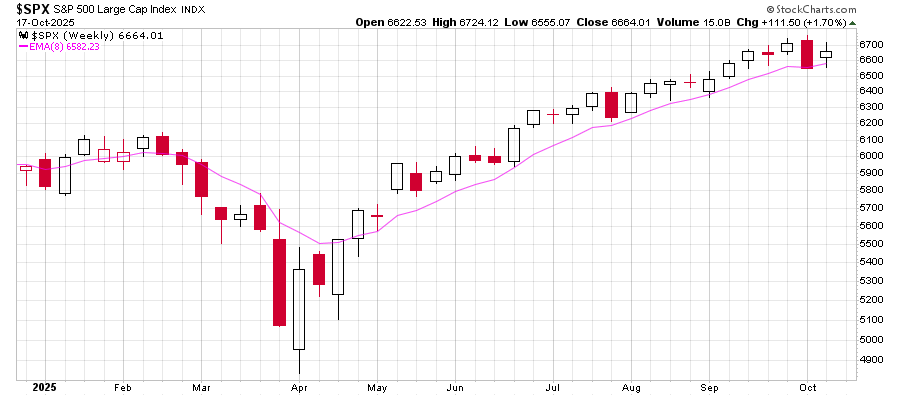

Since the day-to-day, and even hour-to-hour, market action has been noisy and unclear, let’s take a step back and look at a weekly chart of the S&P 500 starting from the beginning of this year.

What do we see? Well, the simplest thing is that the market has been in an uptrend and it has not (yet?) been decisively broken. If you had to guess, you should guess that the trend will continue.

Next, there is that mysterious pink line on the chart. That is the 8-week exponential moving average. We have been watching it for a while now because the market has been faithfully obeying it.

It doesn’t always and there is no law of nature that says it should. But it has been throughout this year’s uptrend. We figured the pink line would stop the selloff, and it did. If it ultimately fails to hold, we think there will be some panic on Wall Street.

Finally, there is that last candle on the chart representing last week’s trading. A candle with a small body roughly in the middle of its range is a “spinning top” and indicative of an indecisive market. Regardless of whether the bulls or bears eventually win out, there could be a stronger than usual move coming.

So, there you have it. This indecisive market is more likely to go up than go down. If it does go down, though, it could get ugly.

SEEN ON THE INTERNETS

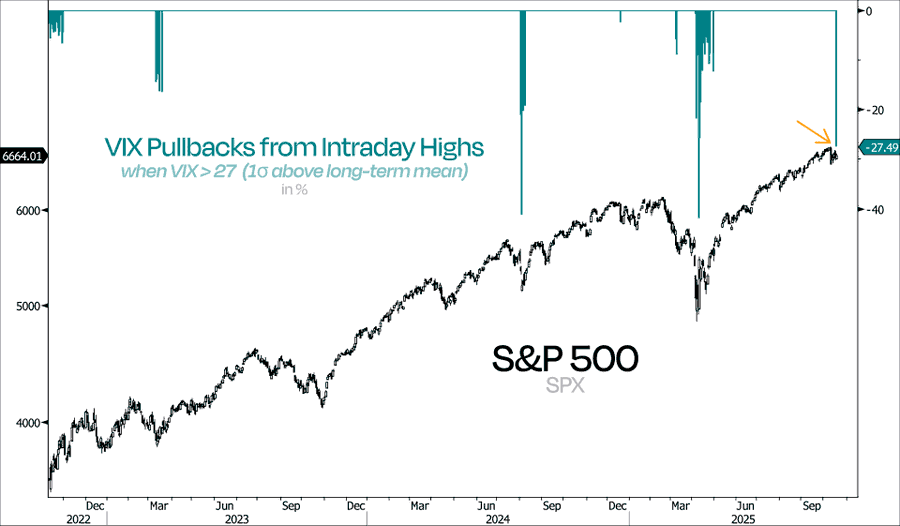

OK, bear with us on this one. The chart we seen this week is a little hard to follow but there is something interesting here.

On Friday, Duality Research posted this fascinating chart comparing the VIX index to the S&P 500. Alot of people do that. What’s the big deal?

The twist here is that they looked at times when the volatility index went above 27 and then fell later in the day. Those are the green icicles hanging down from the top of the chart. The bigger the reversal, the longer the icicle.

Duality says those big reversals mark bottoms in the stock market. The last one happened on Friday.

We would add to it that those conditions tend to happen in clusters. That means you have a series of days where volatility is high then falls, increases again and falls again, and again, and again. So far, we have only one icicle in October 2025.

The bottom may be in, but it could be too early to unfasten your seatbelt.

NUMBERS ONLY

33.0 | A reminder that volatility doesn’t only happen in falling markets, the volatility index for gold ($GVZ) made a 3-year high on Friday. |

1.884 | The equal-weighted ratio of Consumer Discretionary to Consumer Staples (mentioned in last week’s Seen On The Internets) is 1.884. That’s about where it was a week ago. |

$60 million | Zions Bancorp (ZION) discovered $60 million worth of "apparent misrepresentations" (a.k.a. fraud) in its loan portfolio. A rounding error for a bank the size of Zion, but it still caused a mini-panic. |

SWINGEX INDEX

As of market close on: 17 October 2025

|  |

Swingy says: The market's been moving like a cat on roller skates! The index can’t predict where it’s going next and so it sits on neutral.

See some historical examples of the Swingex Index in action here.

WATCHER

Stocks highlighted here each week are not recommendations to buy or sell. They are provided as ideas for swing traders to follow up on with their own research.

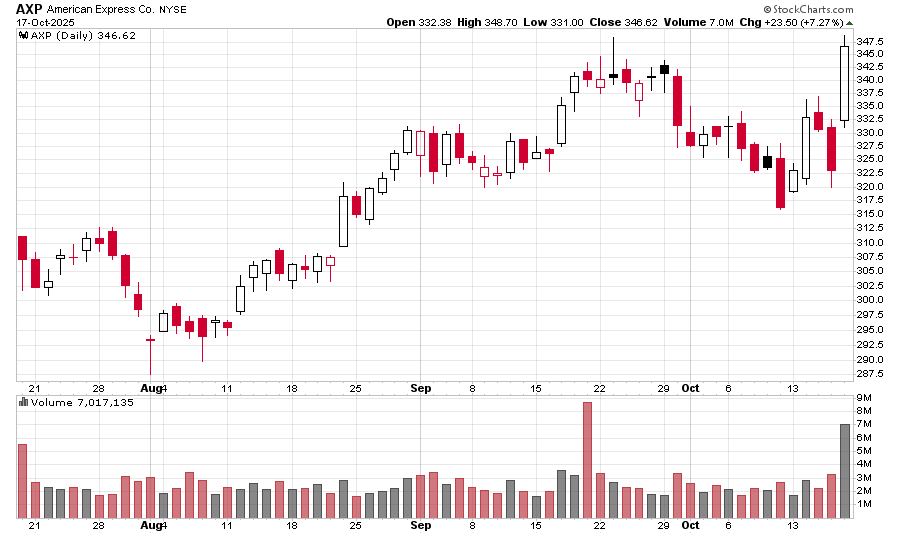

AXP (American Express): The market has been choppy at best lately and it is difficult to find high probability setups amongst the charts. One “old fashioned” stock came through for us, making a new closing high for the 21st century.

American Express ran up 7.27% on Friday after an encouraging earnings report. Hitting a new high is especially impressive considering the weak market overall.

Often times in cases like this the stock will continue walking higher in the days that follow. If it drifts sideways to down for a few days and forms a bull flag, that’s ok too! The only thing you don’t want to see is the stock quickly giving back most of Friday’s gains.